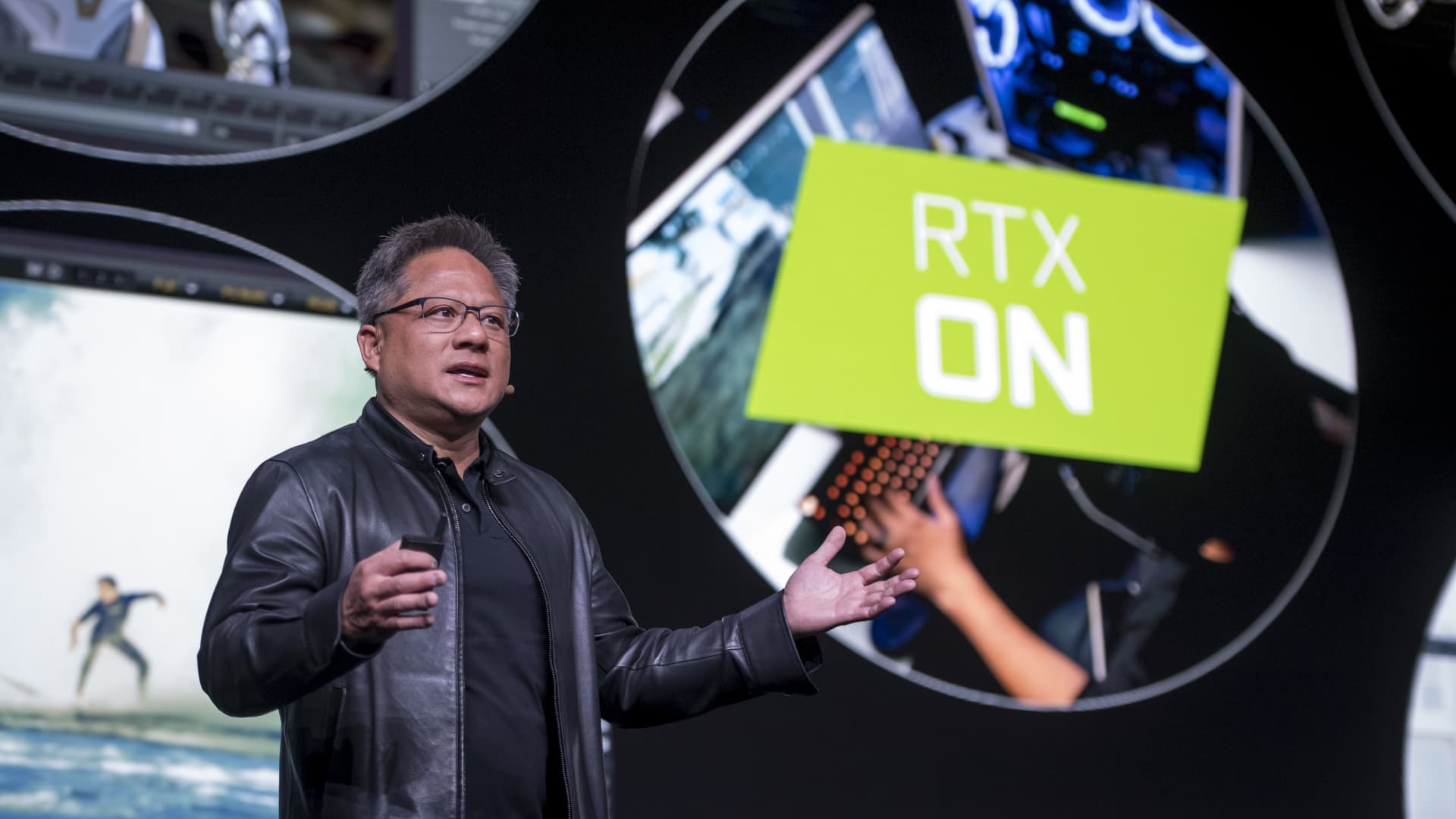

This year has, so far, been something of a Jekyll and Hyde market for equities. January’s strength was a welcome reprieve from the brutality that was 2022. February’s stumble has reminded us that sticky inflation remains a challenge for both the broader economy and stocks. With that in mind, we sifted through our portfolio to find names with a mix of durable fundamentals and stories strong enough to cut through rekindled inflation fears — and the resulting concerns that the Federal Reserve could need to maintain higher interest rates for longer. It’s a dynamic we discussed just last week, charting the ups and downs for the S & P 500 at pivotal moments in the 2023 inflation arc. The criteria for Tuesday’s screen were simple: Stocks had to outperform the market on a monthly basis in both January and February. The returns each month had to actually be positive. The S & P 500 gained nearly 6.2% in January, while losing 2.6% in February. Here are the seven Club holdings that made the cut (and two honorable mentions), arranged by year-to-date performance. Generative AI boost for Nvidia NVDA 1Y mountain Nvidia (NVDA) 1-year performance Nvidia (NVDA) was the Club’s biggest winner in January, climbing 33.7%, and in February its 18.8% monthly gain is second to only Bausch Health (BHC). In January, Nvidia certainly benefited from the broad tailwind that lifted many of 2022’s biggest losers . The stock’s exceptional performance this year goes much deeper to company-specific factors — specifically, all the buzz around generative artificial intelligence (AI). Nvidia’s semiconductors and related software are integral to the budding generative AI field, which generally refers to a type of artificial intelligence that can create text, images and code in response to user queries. Optimism around generative AI began late last year, with the release of ChatGPT, and it’s picked up steam well into 2023. “AI adoption is at an inflection point,” Nvidia CEO Jensen Huang said on the chipmaker’s earnings conference call last week. During that call, Nvidia also indicated a recovery in data center and gaming chips is taking place sooner than many expected, which has only added fuel to investor optimism and contributed to a wave of analyst price-target boosts the following day . Despite this year’s surge, Nvidia shares were still about 18.5% lower than their 52-week high of $289 each back in March. It’s worth noting that fellow Club holding Microsoft (MSFT) has been a huge beneficiary of the AI tailwind this year. The tech giant is a large investor in OpenAI, the startup behind ChatGPT, and the two entities maintain a very close partnership. Microsoft also has made a series of AI-related announcements so far this year, including a revamped version of its search engine, Bing, geared around generative AI. If not for a rough three-day stretch to begin 2023, Microsoft shares likely would’ve made it onto this list of stocks. Ultimately, the stock underperformed the market in January with a gain of 3.3%, disqualifying it. But the stock did beat the market in February, with a nearly 0.7% advance. Bausch bounces, but questions remain BHC 1Y mountain Bausch Health (BHC) 1-year performance Bausch Health (BHC) has had an incredible start to the year, climbing roughly 21% in both January and February. Thanks to a solid earnings report last week, it has managed to hold onto that strong performance. Some of that January move was no doubt attributable to the broader market action, as headwinds certainly remain for Bausch due to its ongoing Xifaxan patent battle. The market was also pleased to see that Brent Saunders is taking the helm at Bausch + Lomb (BLCO). Since Bausch Health still owns over 85% of Bausch + Lomb, what’s good for the latter is good for the former. However, the Xifaxan dispute remains a major overhang on the stock, taming our excitement over its performance so far this year. BHC was still about 62% lower than its 52-week high of just over $24 per share exactly one year ago. Efficiency commitment lifts Meta META 1Y mountain Meta Platform (META) 1-year performance Meta Platforms (META) has really turned it around, gaining roughly 24% in January and over 17% in February. This is one of the best examples in the market of how important it is to acknowledge the operating environment and act accordingly. Last year was brutal for the stock, with management seemingly intent on investing in the metaverse at all costs and planning to grow expenses despite revenues coming under pressure. But it’s a whole new world in 2023. CEO Mark Zuckerberg has completely changed his tune, telling investors on the company’s most recent post-earnings conference call that the focus now is efficiency, efficiency, efficiency . The team has also stressed the important role of artificial intelligence. Investments in AI technology will likely help Meta become more efficient, aid in monetizing previously unmonetized platforms such as WhatsApp and Messenger, all while fending off Chinese competitor TikTok. Meta made this list largely due to a post-earnings surge, but we think the consolidation seen the rest of the month is healthy in the long term. After being crushed last year, shares were recovering but still 26% lower than their 52-week high of nearly $237 each back in April. Palo Alto pivot to profitability PANW 1Y mountain Palo Alto Networks (PANW) 1-year performance Palo Alto Networks (PANW) advanced nearly 14% in January before climbing nearly 19% in February, aided by a very strong quarterly report that demonstrated our investment thesis in the newest Club holding. We started our PANW position in mid-February, adding to it once since then for a nearly 8.5% paper profit so far. The stock was still more than 11% below its 52-week high of $213 per share back in April. As a cybersecurity provider, Palo Alto Networks benefits from being among the highest priorities in corporate IT budgets. Given the company’s strong free cash flow and pivot to profitability , a move that has now resulted in three consecutive quarters of generally accepted accounting principles (GAAP) profitability, we think shares have further room to the upside despite their year-to-date strength. Wynn benefits from China reopening WYNN 1Y mountain Wynn Resorts (WYNN) 1-year performance Wynn Resorts (WYNN) stock has climbed more than 4.5% in February, following a robust 25.7% gain in January. Shares have more than doubled since their 52-week low of around $50 each back in June. There are a few reasons for the stock’s resilience, including continued optimism around a recovery of the casino operator’s business in Macao, a Chinese special administrative region where gambling is legal and a big business. Wynn’s crucial Macao properties stand to benefit in the quarters ahead after China late last year dropped its draconian zero-Covid policy. Wynn’s U.S. operations — in Las Vegas and Boston — have been impressive, too, a clear sign the company is benefiting from consumers’ desire to keep spending on experiences despite inflationary pressures. AMD sees inventory corrections near bottom AMD 1Y mountain Advanced Micro Devices (AMD) 1-year performance After climbing 16% in January, shares of Advanced Micro Devices (AMD) gained 4.6% through February. As with Nvidia, AMD’s January performance was partially aided by the general rotation back into 2022 clunkers. The stock, however, was still about 37% lower than its 52-week high of $125 per share back in March. Recent optimism around artificial intelligence is spilling over into AMD, too. While Nvidia is seen as the best-of-breed AI chipmaker, the tech trend is a clear growth opportunity for AMD, a point CEO Lisa Su made on the firm’s fourth-quarter earnings call in January . AMD also is a cheaper option for investors who want a semiconductor stock poised to benefit from AI, trading at 23.7-times forward earnings, compared with Nvidia’s 52.2 forward multiple, according to FactSet. Some of the inventory corrections that plagued AMD last year — particularly on the PC side — appear to be nearing a bottom, as well. That’s helped improve sentiment. Nvidia’s recent comments on the data center and gaming turnaround it’s seeing may also support optimism around AMD. Apple XXXXXXX AAPL 1Y mountain Apple (APPL) one-year performance. Apple (AAPL) gained just over 11% in January and more than 2.5% in February, reinforcing the Club mantra: Own it, don’t trade. The gains come as the iPhone maker is capturing a greater portion of the global smartphone market, particularly when it comes to high-end models. Gen-Z buyers “increasingly see the iPhone as a must-have,” The Wall Street Journal reported Monday. And the iPhone’s growing popularity with Gen Z shows that Apple is continuing to brandish its image as a status symbol with the next generation of consumers. It also demonstrates how Apple is growing its installed base of users, which should allow the company to ultimately expand its high-margin services revenue. Those developments, combined with the company’s continued commitment to shareholder returns, make Apple a name to hold for the long term. Honorable Mentions We also want to call out two honorable mentions: Morgan Stanley (MS) and Wells Fargo (WFC). Both financial firms outperformed the S & P 500 in January and February. However, they failed the screen due to negative absolute returns in February, despite their outperformance versus the broader market. Wells Fargo lost 0.2% in February, while Morgan Stanley fell 0.9%. Both banks benefit from higher interest rates and an economy that so far has refused to be held down, something of a goldilocks scenario for a business that makes money on the spread between rates and thrives on economic activity. Wells Faro and Morgan Stanley also have significant share repurchase authorizations, which is good news for shareholders . WFC MS 1Y mountain Wells Fargo (WFC) vs. Morgan Stanley (MS) 1-year performance Morgan Stanley is benefiting from an increase in fee-based revenues, part of its multiyear shift toward asset management to smooth out the cyclical fluctuations of its traditional investment banking franchise. Wells Fargo, meanwhile, is seeing great benefits from the interest rate spread between what it charges for loans and pays out on deposits. Wells Fargo also is a turnaround story, working diligently to achieve regulatory milestones that will let it free up additional capital for investments and shareholder returns. Bottom line Wall Street hit a rough patch in February, but that didn’t prevent certain Club stocks from breaking through. Of the names mentioned above, Palo Alto, Apple and Wells Fargo are 1-rated stocks , indicating our view that they can be bought here and now. With the exception of Bausch Health, which we think has to be avoided until more is known about the Xifaxan patent litigation, we are actively looking to buy the remaining stocks on this list on pullbacks, as signified by our 2 rating. We believe they’re best-in-class businesses led by top-tier management teams with further long-term upside. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Jensen Huang, president and CEO of Nvidia, speaks during the company’s event at the 2019 Consumer Electronics Show in Las Vegas on Jan. 6, 2019.

David Paul Morris | Bloomberg | Getty Images

This year has, so far, been something of a Jekyll and Hyde market for equities.

January’s strength was a welcome reprieve from the brutality that was 2022. February’s stumble has reminded us that sticky inflation remains a challenge for both the broader economy and stocks.