KARACHI:

As the ominous looking clouds that signify increasing economic challenges for Pakistan continue to gather, there is a desperate need to control the burgeoning crisis.

The government introduced a supplementary bill in February 2023 to increase sales tax on certain goods and services as well as income tax on certain capital investments. As economic conditions worsen and the government finds itself deeper in the abyss, the consumers and investors will likely face an increasing burden of taxes.

These challenges suggest that Pakistan needs rethinking, if not resetting, in terms of adopting new trade strategies and ideas to escape the vicious trap involving the recurring balance of payments crisis.

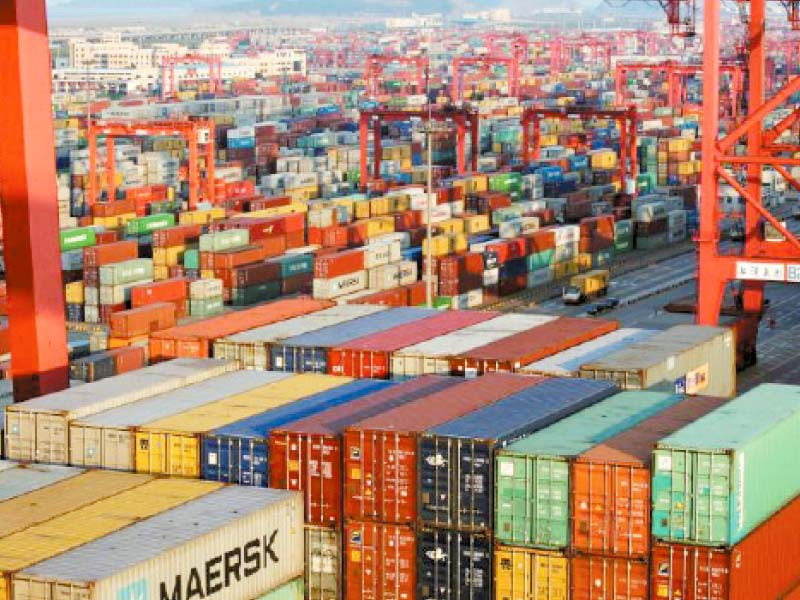

One important factor that leads to the recurring balance of payments crisis is the large trade deficit, calculated as the value of imports less the value of exports.

According to the Pakistan Bureau of Statistics, imports exceeded exports by $48.4 billion in FY22. Exports were at $31.8 billion while imports were at $80.2 billion.

Although both trade flows were the highest ever in Pakistan’s history, the lack of ability to generate enough exports, as they were less than 40% of total imports, will result in a crisis every few years. It is imperative to escape this trap.

Any new agenda that is developed as a way forward must address the most critical issue – the unsatisfactory exports. Exports have been relatively stagnant with negligible growth, particularly in comparison to countries such as Bangladesh and Vietnam, which have achieved exceptional growth over the past decade.

According to the International Trade Centre’s Trademap.org, Pakistan has never exported more than $28.9 billion worth of goods in a calendar year. The previous highest was in 2011, when Pakistan exported $25.3 billion worth of goods.

In comparison, Bangladesh exported $24.3 billion worth of goods in 2011. It increased its exports to $53.9 billion in 2021. Vietnam reported exports of $96.9 billion in 2011, which increased to $335.8 billion in 2021. Exports as a percentage of GDP in Pakistan has decreased as it was reported to be less than 10% in 2021, sharing the same levels as reported by some of the poorer sub-Saharan African countries and least developed countries.

Imports into Pakistan have increased from $43.6 billion in 2011 to $73.1 billion in 2021. A similar trend was reported for Bangladesh, while Vietnam’s imports increased from $106 billion to $330 billion in the same time period.

It is important to note that imports increase as economies grow and consumer demand expands. However, unlike Bangladesh and Vietnam, Pakistan has failed to increase its exports, leading to a burgeoning trade deficit.

One of the biggest challenges that Pakistan faces is the lack of diversification in exports. Exports from Pakistan are heavily concentrated in textiles and cereals, which dominate the top 10 products exported from the country. Although Bangladesh has a similar composition, it exports more value-added apparels and garments, while Pakistan’s top 10 export products include lower value-added bed linen and towels.

On the other hand, Vietnam has expanded its export basket to include more high value-added and sophisticated products. It exported more than $33.6 billion worth of cellphones in 2021, becoming their second largest exporter in the world. It had reported zero exports in 2007.

A major reason for the inability of Pakistan’s exporters to participate in exporting activities is the lack of competitiveness, which is associated with low levels of productivity and high trade costs.

As the increase in trade deficit creates jitters amongst policymakers, they often resort to increasing trade restrictions and imposing inward-looking policies to reduce the trade deficit. Import restrictions and increase in import tariffs on several commodities have resulted in a shortage of goods and reduction in manufacturing activities in the country.

The Business Confidence Index, published by the State Bank of Pakistan in collaboration with the Institute of Business Administration, Karachi, notes not only a sharp reduction in the overall business confidence since last year but also in capacity utilisation in the manufacturing sector. Such challenges are likely to dent exports further.

One of the key issues that Pakistan faces is the lack of access to consumers in its key markets. Although the European Union has provided duty-free access to several items under the GSP Plus scheme, Pakistan’s exporters fail to meet EU standards.

Furthermore, given that the United States is by far the largest export destination for Pakistan, major textile products imported from Pakistan show tariff rates of up to 17%. The recently started dialogue on trade and investment between Pakistan and the US must address the tariff issues as increased market access can help boost the capabilities of Pakistan’s exporters.

Finally, it is imperative to reduce the trade costs incurred by domestic producers. One of the biggest deterrents to participation in exporting activities is the presence of information asymmetries.

For instance, the lack of information on various technical measures inhibits exporters. Pakistan Single Window and TDAP have taken steps to reduce this information asymmetry.

However, roadshows and training programmes targeted at SME exporters are the need of the hour.

The writer is the Assistant Professor of Economics and Research Fellow at CBER, Institute of Business Administration, Karachi

Published in The Express Tribune, March 13th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.