KARACHI:

The stock market maintained its upward momentum in anticipation of some positive announcements in the federal budget for FY24 and on hopes of an agreement with the International Monetary Fund (IMF).

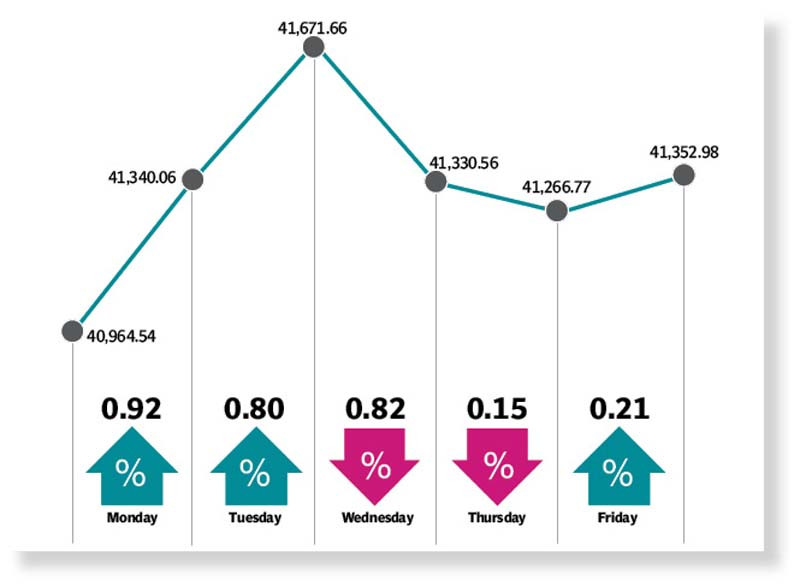

At the end of the week, the KSE-100 index managed to close in the green and surpassed the 41,000-point barrier.

On Monday, trading kicked off on a positive note owing to corporate announcements about issuance of bonus shares to avoid the imposition of a tax in the upcoming budget with further support coming from sector-specific activity.

Market sentiment strengthened on Tuesday after the IMF mission chief’s statement that the lender had continued its engagement with Pakistani authorities.

The bourse remained range bound on Wednesday and Thursday, erasing gains as an IMF statement about domestic politics sparked concerns. Furthermore, news regarding imposition of new taxes in the FY24 budget prevented investors from building positions.

Towards the end of the week, the investors showed optimism over hopes of a new IMF loan programme and likely allocation of Rs900 billion for the Public Sector Development Programme (PSDP).

However, uncertain political and economic scenario weighed on investors’ mind and as a result the market ended the week with marginal gains.

The benchmark KSE-100 index registered an increase of 388 points, or 0.95% week-on-week (WoW), and settled at 41,352. JS Global analyst Wasil Zaman, in his report, noted that the KSE-100 started the week on a positive note followed by partial correction.

Sector-wise, cement (up 3.8% WoW) and engineering (up 3.2%) were the major outperformers while pharmaceutical (down 1.3%) and power (down 0.7%) were the key under-performers. Foreigners turned net buyers during the week with buying of $3.6 million worth of shares with the highest buying witnessed in the food sector while major selling came in the tech sector, he said.

On the news front, the IMF loan programme continued to hang in the balance as both sides indicated that talks were underway. Prices of petrol and diesel were cut by Rs8 per litre and Rs5 per litre, respectively. Inflation for May 2023 hit a record high at 38% year-on-year with urban inflation at 35% and rural inflation at 42%.

State Bank’s foreign currency reserves fell by $102 million to $4.1 billion due to external debt repayments.

Cement sales during May 2023 rose 34% month-on-month (MoM), indicating a pickup in construction activities while sales of oil marketing companies (OMCs) rose 11% MoM to 1.30 million tons as compared to 1.17 million tons in the previous month, the JS analyst added.

Arif Habib Limited, in its report, said that the stock market opened on a positive note in anticipation of certain budgetary measures including a tax on corporates that had avoided payouts recently, which was likely to force companies to revive payouts. “Moreover, an IMF statement indicated that it continued to engage with Pakistan’s government to pave the way for a board meeting to resume the loan programme,” it said.

However, market momentum started slowing down as latest economic numbers showed that inflation surged to the highest level at 38% in May 2023 as compared to 36.4% in April 2023 and 13.8% in May 2022.

The rupee depreciated against the US dollar by Rs0.52 (-0.1% WoW), closing the week at 285.67/$. In terms of sectors, positive contribution to the bourse came from technology and communication (110 points), cement (100 points), fertiliser (75 points), exploration and production (53 points) and engineering (29 points).

Negative contribution came from pharmaceuticals (22 points), commercial banks (18 points), OMCs (12 points), food and personal care products (6 points), and cable and electrical goods (5 points).

In terms of stocks, positive contributors were Systems Limited (73 points), Dawood Hercules (70 points), United Bank (60 points), DG Khan Cement (38 points), and TRG Pakistan (35 points), AHL added.

Published in The Express Tribune, June 4th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.