Getty Images

Getty ImagesIn 2010 the Gulf state of Qatar bought luxury department store Harrods for £1.5bn, via its sovereign wealth fund, the Qatar Investment Authority.

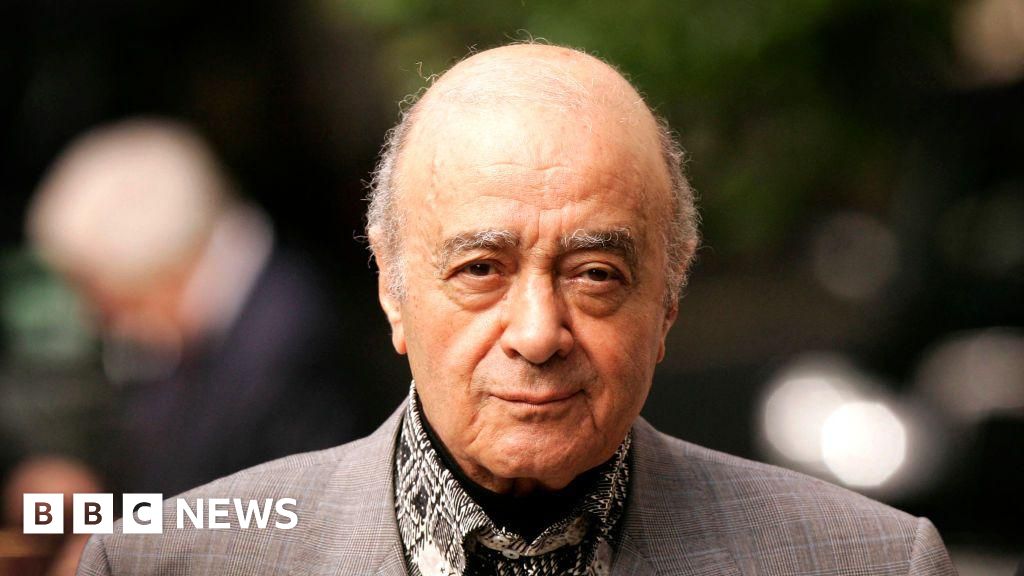

It should have been the jewel in the Qatari crown. However, Harrods now faces serious sexual abuse allegations over the actions of its former boss, Mohamed Al Fayed.

Many of these claims were uncovered in a recent BBC investigation, but multiple legal experts have said Qatar either missed or dismissed much of what was already known about Al Fayed at the time of the purchase.

This includes a 2008 police investigation into the alleged assault of a 15-year-old girl in a Harrods boardroom.

Harrods has told the BBC it is “utterly appalled” by the allegations and has apologised to the victims.

It now looks as if the scandal could cost the company and its owner millions.

So what, if anything, was known by Qatar about the allegations?

‘Inadequate’ due diligence

When a company buys another company, the process of looking to see if there are any skeletons in the cupboard is known as due diligence.

The buyers will hire advisers who will ask the seller’s advisers questions about any issues they should know about. They may also do their own independent research.

When the owner is someone like Mohamed Al Fayed, who had several allegations surrounding him at the time of the deal, the buyer’s due diligence process should be lengthy.

“I think it would be sensible to ask detailed questions about number of claims, number of complaints – informal or formal – even if not upheld, subject of the complaints even if they were not upheld, number and value of settlements, number of NDAs (non-disclosure agreements),” says Beth Hale, a partner at law firm CM Murray.

In “exceptional cases” this information might scupper a deal, though she believes it is more likely the buyer would ask the seller to compensate them for any losses that might come from the alleged behaviour.

This is what Ms Hale says a business should do if it were buying a company like Harrods in 2024, but she says that 2010 was a different time.

She says this pre-#MeToo era was a “world away in terms of attitudes and approaches to sexual harassment”.

“Sexual harassment claims did not form as big a part of due diligence then as they do now.”

She says it appears that either Qatar’s due diligence was “not adequate” or that the process did bring up certain claims and it decided to continue in any event, perhaps imagining that they might not end up hurting the company too badly.

“Pre-#MeToo, with a couple of sexual harassment claims, a company might settle them, get an NDA, and move on.”

Catriona Watt, partner at Fox & Partners, says it looks as if Qatar may have known about the allegations but went ahead anyway.

“It seems to me that it wasn’t a complete secret. It was probably a calculated risk,” she says, adding the due diligence process “depends on the questions you ask”.

“You might say, ‘I only want to know about this if it has a value of X,”‘ she says.

Virginia Albert, former marketing professor and current account director at advertising agency DeVito/Verdi, also believes the Qatari government’s views on women’s rights are relevant.

She questions whether it would have considered sexual abuse allegations as something sufficiently serious enough to warrant dropping the deal

“You could argue that brands align with brand values during mergers,” she says, adding the Gulf state would have considered if its values “aligned with what they knew, if they knew, about the values of this department store”.

Lazard, which represented the Al Fayed Trust during the deal, told the BBC: “We strongly condemn the behaviour these reports have brought to light.”

Harrods and the Qatar Investment Authority did not reply to multiple requests for comment on the due diligence process when the company was bought. In its previous response to the BBC, Harrods said it had been settling claims “since new information came to light” last year.

Meanwhile, Harrods’ managing director Michael Ward said on Thursday: “While it is true that rumours of [Al Fayed’s] behaviour circulated in the public domain, no charges or allegations were ever put to me by the police, the [Crown Prosecution Service], internal channels or others.

“Had they been, I would of course have acted immediately.”

Credit Suisse, now owned by UBS, represented the Qatar Investment Authority in the deal and declined to comment.

Compensation and reputation

Whatever Qatar knew during the deal, the impact of the allegations is likely to be substantial.

First, there is the total cost of payments to the survivors of the alleged sexual abuse by Al Fayed, which multiple legal experts have told the BBC could be in the millions, with each individual claim likely to cost the firm a six-figure sum.

Harrods has accepted vicarious liability for some of the claims, a legal term meaning it accepts ultimate responsibility for Al Fayed’s alleged actions.

It could potentially be liable for alleged failings as an employer, including for claims such as negligence or failing to provide a safe working environment, experts predicted.

Defending the legal case and hiring an independent investigator to look into the claims are also expected to be six-figure sums.

However, the real damage is expected to be reputational.

“People are going to be really, really pissed,” says Ms Albert, adding that many will want to see Harrods dealing with the serious allegations from the survivors swiftly and thoroughly.

“There’s so much more visibility now than there was.”

What might save Harrods, she says, is the loyalty of its long-time shoppers, but the high-price point will make it much easier for casual customers who dislike the way the retailer is perceived to have treated women to go elsewhere.

She predicts boycotts and says the business may struggle to recover unless customers see action, rather than just words.