Last Updated:

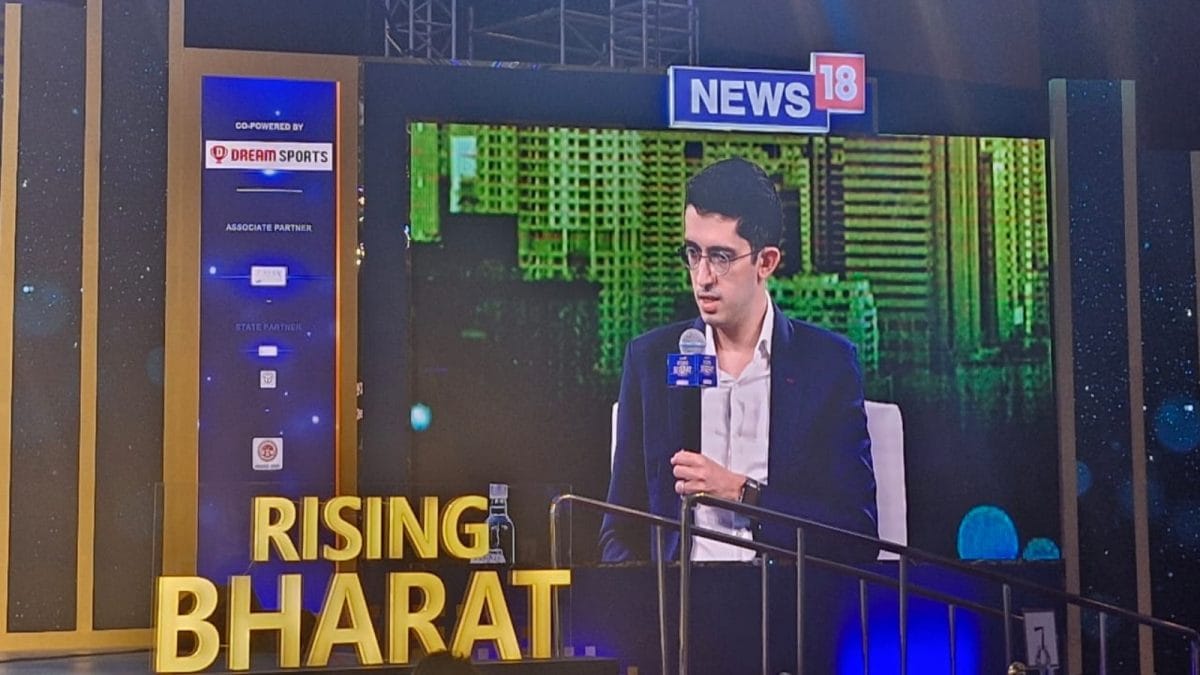

Jay Kotak said that India’s banking landscape is being transformed by digitisation, UPI, Aadhaar, and changing consumer expectations, stressing that banks must step up customer engagement to stay competitive.

Jay Kotak, Co-Head of Kotak 811 and Senior Vice President of Conglomerate Relationships at Kotak Mahindra Bank, at the CNN-News18 Rising Bharat Summit 2025. (Image: News18)

Indian banking is undergoing a seismic shift driven by digitisation, UPI, Aadhaar, and changing consumer expectations, said Jay Kotak, Co-Head of Kotak 811 and Senior Vice President of Conglomerate Relationships at Kotak Mahindra Bank, at the CNN-News18 Rising Bharat Summit 2025. He stressed that traditional banks must enhance customer engagement to stay competitive against fintech disruptors.

Speaking during the panel discussion Zoomer Zest: The New Age Indians, Kotak said widespread mobile telephony, affordable devices, Aadhaar, demonetisation, and the COVID-19 pandemic had collectively accelerated financial innovation in India. “Customers are now much more demanding of how their financial institutions serve them,” he said.

Kotak also responded to a recent comment by Uday Kotak, founder and former CEO of Kotak Mahindra Bank, and Jay’s father, who noted that many heirs of family businesses today prefer managing investments rather than running operational businesses. Emphasising the need for the next generation to be more hands-on, Jay Kotak said, “Where India is today, the next generation should lean towards operating.”

His remarks came against the backdrop of a broader debate sparked by Uday Kotak, who recently said that India’s next generation of business families was prioritising stock market speculation and asset management over building and running businesses.

Drawing a parallel with the United States a century ago, Jay Kotak pointed out that in the early days of American industrialisation, the sons and daughters of the largest industrialists were actively involved in running businesses, building companies, and expanding operations. It was only after several generations that the trend shifted towards managing investments and financial portfolios. “It’s only now, many generations later, that folks veer more into the investment side in the US,” he said, implying that India’s next generation of business leaders must first focus on operating and building businesses before moving towards investment-led roles.

Shashwat Goenka, Vice Chairman of the RP-Sanjiv Goenka Group, offered a more nuanced perspective, arguing that operational leadership and strategic investment can go hand in hand. “It’s not either-or — you can do both,” he said. Goenka emphasised that while it is important to be actively involved in operational roles to stay connected to customers, supply chains, and markets, it is equally crucial to strategically invest and grow family wealth. “Today, the wealth creation opportunities that are available make it important to incubate startups and invest smartly, while also running businesses hands-on,” he said. Highlighting the backgrounds of himself, Lavanya Nalli, and Jay Kotak, Goenka pointed out that all three, despite being from different generations of business families, are balancing operational leadership and investment.

Lavanya Nalli, Vice Chairperson of the Nalli Group of Companies, reflected on her experience as the first woman from her family to join the business. She emphasised that having a choice to operate or not is a positive change. “It’s good that today’s generation can follow their calling without worrying about financial sustenance,” she said. However, she stressed that operating within the business remains valuable. “Having a thoughtful, intentional leadership programme for heirs — like a rotational programme across functions — can set up succession for success,” she said, citing the Murugappa Group’s model.

Nalli also spoke about the risks of complacency for successful traditional businesses. “Sterility of success is a real risk,” she warned, recalling her push to start Nalli’s e-commerce business in 2016. She explained that disruptive trends often seem unimportant at first but can overtake incumbents if they fail to act early. “The only way to stave off disruption is to disrupt yourself,” she said, adding that creating independent disruptive units is key to survival.

On the subject of capital allocation for new ventures, Goenka stressed the importance of data-driven decisions. “Today, disruption is imminent across sectors — from policy changes to AI. Businesses must evolve to stay relevant,” he said, adding that calculated risks are essential for long-term growth.

In closing remarks, each speaker shared their aspirations for the future. Jay Kotak said he hopes to see Kotak Mahindra Bank emerge as a leader in digital banking. “Hopefully the number one player — as soon as possible,” he said. Shashwat Goenka focused on ensuring that his group remains relevant and continues to help shape India’s economy. Lavanya Nalli said her vision is to keep the consumer at the centre, innovating products and experiences for future generations.

The session highlighted how India’s new-age business leaders are blending tradition with transformation — redefining ambition for a changing India.