The next surge of Indian investors will be from Bharat, tehe survey said. (Representative image)

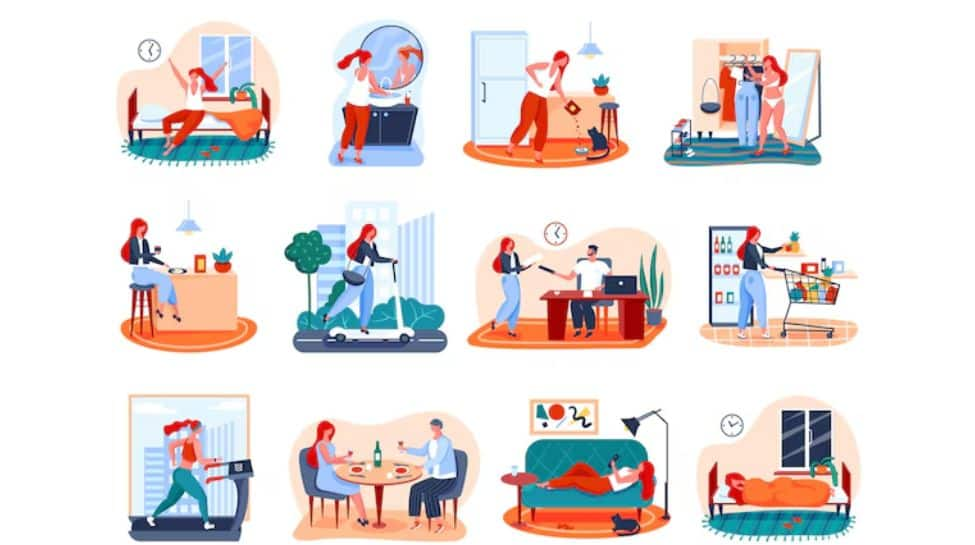

As investors age, their investment journey becomes more fulfilling, particularly after 35.

Research & Ranking, the equity investment advisory brand, a part of Equentis Wealth Advisory Services Private Limited, launched its first investor survey titled ‘The Indian Investor Kundli’. It revealed that Indian investors tend to show a strong inclination towards investing directly in equities once they reach the age of 35.

The survey added that over 50% of these investors hail from non-metro cities, indicating a growing interest in financial markets beyond the major urban centres. Notably, around 50% of these investors have yet to experience a complete business cycle, suggesting they may have limited exposure to market fluctuations.

However, a significant majority of around 60% of Indian investors adopt a long-term investing approach, emphasising their commitment to holding investments over extended periods.

The Indian Investor Kundli study aims to understand Indian investor patterns nationwide.

It provides insights into demographics, aspirations, investment style, and portfolio sizes. The report is designed like a Kundli (a horoscope), adding an authentic and visually appealing touch.

Over 2000 respondents participated in this survey conducted over three days.

CAGR factor

On the performance front, around 30% of investors have underperformed the index, while a considerable 27% remain uncertain about their Compound Annual Growth Rate (CAGR).

As investors age, their investment journey becomes more fulfilling, particularly after 35. Older Indian investors are keen on upgrading their lifestyle through their investment endeavours.

Furthermore, with increasing age, investors tend to become more comfortable with a lump sum investment approach, reflecting higher confidence and risk tolerance. Moreover, the CAGR tends to improve with age, indicating the potential for enhanced returns over time.

Manish Goel, founder and director, Research & Ranking, said, “50% of the investors have expressed a bullish outlook for FY24. This survey reinforces our belief that there is immense potential in the market, as it demonstrates that individuals across India are eager to upgrade their lifestyle and improve their quality of life, regardless of their location.”

Sham Srinivas, VP, marketing, Research & Ranking, added, “As marketers, we embrace the power of data-driven decision-making, and this report empowers us to make informed choices that will help us drive meaningful engagement and deliver exceptional results. It’s a testament to our commitment to staying ahead of the curve, anticipating trends, and adapting swiftly to meet the evolving needs of Indian investors.”