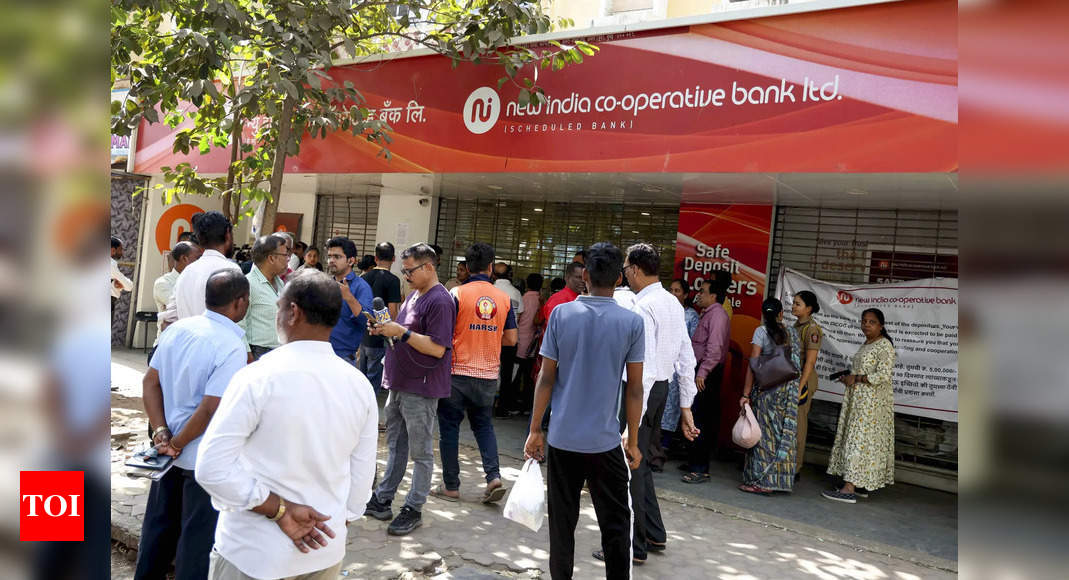

NEW DELHI: A Mumbai court ordered Hitesh Mehta, the former general manager and head of accounts at New India Cooperative Bank, into police custody over the alleged Rs 122 crore misappropriation case.

The holiday court on Sunday remanded Mehta and his co-accused, Dharmesh Paun, in custody until February 21 as the economic offences wing (EOW) continues investigation.

The case came to light after Devarshi Ghosh, the bank’s acting CEO, filed a complaint at Dadar police station on 14 February, alleging that Mehta and his associates conspired to deviate off funds from the bank’s Prabhadevi and Goregaon branches. Following this, the FIR was registered in the early hours of Saturday, and given the scale of the scam, it was later handed over to the EOW.

Authorities have charged the accused under sections 316 (5) and 61(2) of the Bharatiya Nyay Sanhita (BNS). Initial findings suggested that the fraudulent transactions took place over a five-year period between 2020 and 2025. The discrepancies in the bank’s accounts were first indicated during an internal audit, leading to the police complaint.

Aftermath of FIR

The Reserve Bank of India (RBI) intervened, taking over the bank’s board for a year and appointing an administrator, Shreekant (former chief general manager at the State Bank of India), to oversee its affairs.

A ‘committee of advisors,’ comprising former SBI General Manager Ravindra Sapra and Chartered Accountant Abhijeet Deshmukh, has also been formed to assist.

The RBI’s move follows its decision to impose restrictions on withdrawals, citing “material concerns” over failures at the Mumbai-based cooperative bank.

The EOW has seized financial records for forensic auditing to determine the full scale of the fraud and identify any additional suspects.