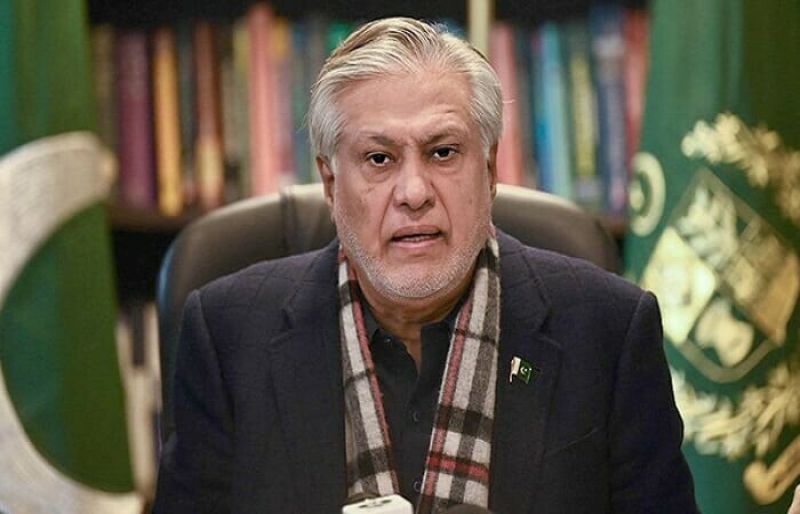

In a last-ditch effort to clinch a stalled rescue package with the International Monetary Fund (IMF), the government has agreed to introduce a number of changes to its budget for the fiscal year 2024, confirmed Finance Minister Ishaq Dar on the floor of the National Assembly.

“In the last three days, Pakistan’s economic team has held detailed negotiations with the IMF team to complete the pending review,” Dar said in his address to wind up the Federal Budget 2023-24 debate in the National Assembly.

“As a result of these negotiations, the government is eyeing to impose additional taxes to the tune of Rs215 billion. These amendments will be tabled. However, we have ensured that the impact of these taxes would not be passed to the downtrodden,” he said.

“We have decided to reduce our expenditure by Rs85 billion. However, the reduction will not be from PSDP, salaries of government employees and pensions.”

“I have a belief that if the IMF programme is resumed then it’s all good, but if it doesn’t we will still suffice,” he said.

The Finance Minister said both sides held consultations over the last three days. He said we have agreed to take additional taxation measures of 215 billion rupees, clarifying that it will not burden the poor people. Similarly, he said we have agreed to reduce current expenditures by 85 billion rupees.

He made it clear that this reduction will not affect the annual development plan as well as salaries and pensions of government employees. He said the IMF has agreed to our stand.

The Finance Minister said we believe in complete transparency and that is why the details of the meetings with the IMF are being shared with the public.

He said once the agreement is reached with the IMF, it will also be uploaded on the website of the finance ministry.

Ishaq Dar said as a result of the understanding reached with the IMF, he said the annual FBR tax collection target is being enhanced from 9200 billion rupees to 9415 billion rupees.

The total outlay of the budget will now be 14480 billion rupees. He was confident that these measures will also help reduce the fiscal deficit.

Referring to the burgeoning budget of pension, the Finance Minister said it has become unsustainable. He announced a series of pension reforms, including the establishment of the Pension Fund. He said rules and regulations for the fund are being framed. He also announced the abolishment of multiple pensions for the officers of grade 17 and above, saying the retired officer will now receive only one pension.

He said that after the death of a pensioner and his or her spouse, the dependents will receive the pension up to 10 years only. In case of reemployment after the retirement, the officer may opt either for the pension or the salary. He stressed that these difficult decisions are imperative to steer the country in the right direction.

The Finance Minister further said that the government will continue providing essential commodities to the people at reduced rates through the Utility Stores Corporation. For this purpose, an amount of 35 billion rupees has been allocated, including five billion rupees for Ramazan Package and 30 billion rupees for the Prime Minister Relief Package. He said the allocation for Benazir Income Support Programme is also being revised up to 466 billion rupees.

Commending the services and sacrifices of the armed forces in defence of the country, Ishaq Dar assured the timely release of sufficient funds to them as envisaged in the budget.

The Finance Minister said 30 billion rupees have been reserved to deal with the issue of climate change and food security. He said 30 billion rupees have been earmarked for the solarization of agri tube-wells and 31 billion rupees for the youth.