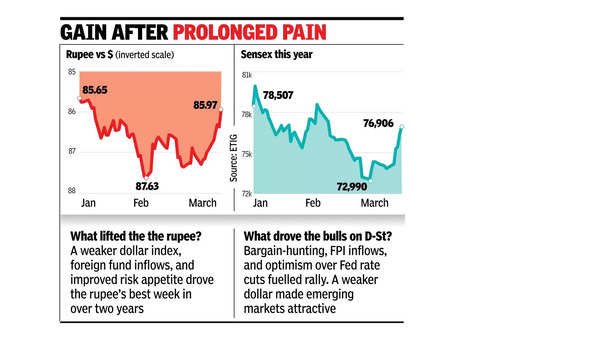

MUMBAI: The rupee on Friday regained 85 level, posting its strongest gain against the dollar in over a month, supported by foreign fund inflows and the unwinding of speculative long-dollar positions. Meanwhile, the sensex and Nifty both continued their northward movements and closed higher, their fifth consecutive sessions of gains.

The rupee recorded its best weekly performance in more than two years, strengthening 1.2%. The rupee ended at 85.97 against the dollar, up 40 paise from 86.37 in the previous session, after touching a 10-week high of 85.94.

The rupee strengthened past 86 for the first time since Jan, driven by a surge in foreign investments in the domestic capital and debt markets, Dilip Parmar of HDFC Securities said. Stronger-than-expected trade data and rising forex reserves, aided by RBI’s dollar/rupee swap intervention, further bolstered the rupee. He said the local currency had emerged as the top performer among Asian currencies this month. In the near term, the rupee has support at 85.70 and resistance at 86.45. If the rupee fails to breach 85.90, it may face depreciation pressure, with immediate support in the 86.80-87.00 range.

The Fed’s decision to hold rates steady and signal lower interest rates pulled the dollar down, supporting the rupee, Jateen Trivedi of LKP Securities said.

Large foreign banks consistently offered dollars in the dollar/rupee pair. Equity inflows linked to the FTSE All-World Index rebalancing, effective from Friday, likely supported the rupee, with the rebalancing expected to bring inflows of around $1.5 billion.

Nifty rose 0.7% on Friday. Foreign portfolio investors, who had been selling Indian equities since late last year, turned buyers in two of the last four sessions, according to provisional data. The US economic data, including flash services and manufacturing figures due Monday, will influence market sentiment.

On Dalal Street, the sensex and Nifty both opened marginally lower on Friday, after four consecutive sessions of gains, but soon reversed early trends to gain through the session. At close sensex was up 557 points to 76,906 points while Nifty was up 160 points at 23,350 points. In the last five sessions, both the indices have gained over 4% each, marking their best weekly gains in over four years.

The day’s rally came on the back of strong buying by foreign funds who pumped in net Rs 7,470 crore into stocks. On the other hand, domestic funds were net sellers at Rs 3,202 crore, BSE data showed.