Tax policies were left unchanged, major subsidies on food, fertiliser, and fuel were 8% lower and an allocation for the MGNREGA rural employment scheme was held steady in the 2024 interim budget read out in Parliament by union finance minister Nirmala Sitharaman on Thursday ahead of the Lok Sabha elections due by May.

The interim budget is seen as a stop-gap fiscal plan during an election year, aimed at meeting immediate financial needs before a new government is formed. The full union budget will only be released after the elections.

“I propose to retain the same tax rates for direct and indirect taxes, including import duties,” Sitharaman said.

The minister, however, proposed to withdraw outstanding direct tax demands of up to Rs 25,000 till FY09/10 and up to Rs 10,000 for FY10/11 to 14/15, and said it would benefit around one crore taxpayers.

Sitharaman said direct collections had more than trebled in the past 10 years, and the number of people filing returns had increased 2.4 times.

“The Indian economy has witnessed profound positive transformation in the last ten years. The people of India are looking ahead to the future with hope and optimism,” the minister said.

She added that the needs, aspirations and welfare of Garib (Poor), Mahilayen (Women), Yuva (Youth) and Annadata (Farmer) is the PM Modi-led government’s “highest priority”.

Presenting her sixth straight (but first interim) budget, Sitharaman also said that Prime Minister Narendra Modi’s government is working to make India a ‘Viksit (Developed) Bharat’ by 2047 and that this development would be “all-round, all-inclusive, and all-pervasive”.

“Our vision for Viksit Bharat is that of a prosperous Bharat… in harmony with nature and modern infrastructure, and providing opportunities for all to reach their potential,” she said. “The next five years will see unprecedented development and golden moments to realise the goal of a developed India.”

Sitharaman said the government plans to form a “high-powered committee” for an “extensive consideration of challenges arising from fast population growth and demographic challenges”.

“The committee will be mandated to make recommendations to address these challenges comprehensively, in relation to the goal of ‘Viksit Bharat’,” she explained.

Sitharaman said that India’s fiscal deficit is estimated to be 5.1% of the gross domestic product in the financial year 2024-25. The country’s total borrowing during the fiscal is estimated at Rs 14.13 lakh crore. She said that the fiscal deficit in the financial year 2023-24 is expected to be 5.8% – marginally below the previous budget estimate of 5.9%. The union government will continue on the path of fiscal consolidation to reach a fiscal deficit target below 4.5% by the financial year 2025-26, she announced.

Sitharaman said FDI (foreign direct investment) inflow between 2014 and 2023 had marked a “golden era”. The sum of $596 billion was twice that between 2005 and 2014, she said.

“To encourage sustained foreign investment, the government is negotiating bilateral investment treaties with our foreign partners in the spirit of FDI, or ‘First Develop India’,” she said.

The highest allocation in the budget was for the ministry of defence at Rs 6.2 lakh crore, followed by MoRTH at Rs 2.78 lakh crore, and railways at Rs 2.55 lakh crore.

“Our government has provided transparent, accountable, and people-centric, trust-based administration, with citizen-first, minimum-government, and maximum-governance mode,” she said in her speech.

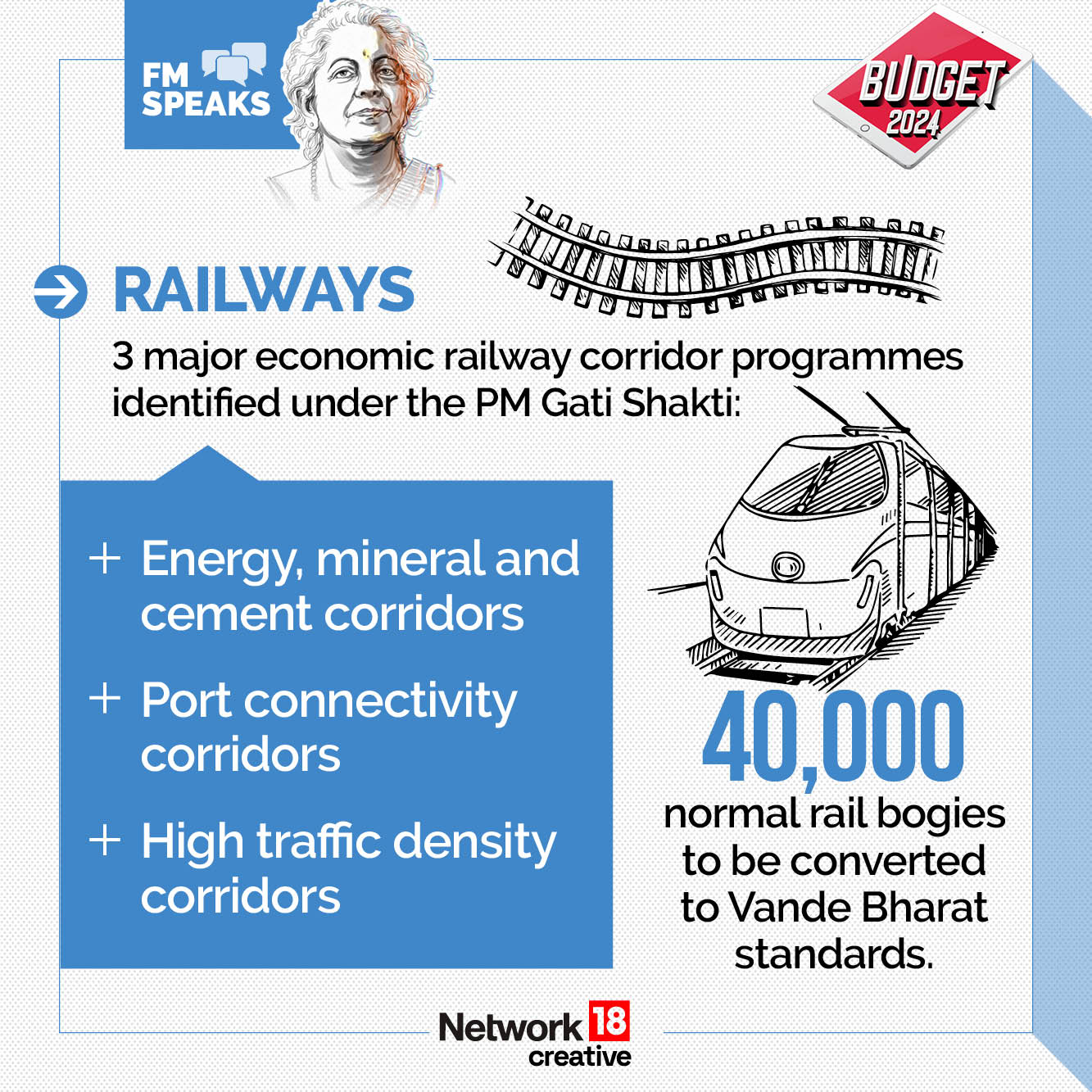

The minister said that 40,000 normal rail bogies will be converted to “the Vande Bharat standards” to improve passenger safety and comfort. She also announced three major economic railway corridor programmes under PM Gati Shakti: energy, mineral and cement corridors; port connectivity corridors, and high traffic density corridors.

The union government has proposed to raise the capital expenditure for the financial year 2024-’25 by 11.1% to Rs 11.11 lakh crore. This would be 3.4% of the GDP.

The union government allocated Rs 86,000 crore for the job guarantee scheme under the Mahatma Gandhi National Rural Employment Guarantee Act for FY25, which is the same outlay as given in the revised estimates for the current financial year.

Sitharaman said that a new scheme would be launched to help “deserving sections of the middle class ‘living in rented houses, or slums, or chawls and unauthorised colonies’ to buy or build their own houses”. She also said that two crore more houses will be taken up under the Pradhan Mantri Awas Yojana (Grameen) in the next five years.

The finance minister announced that a new fund will be created with a corpus of Rs 1 lakh crore that will grant 50-year interest-free loans to promote innovation. “This will encourage the private sector to scale up research and innovation significantly in sunrise domains,” she said. “We need to have programmes that combine the powers of our youth and technology.”

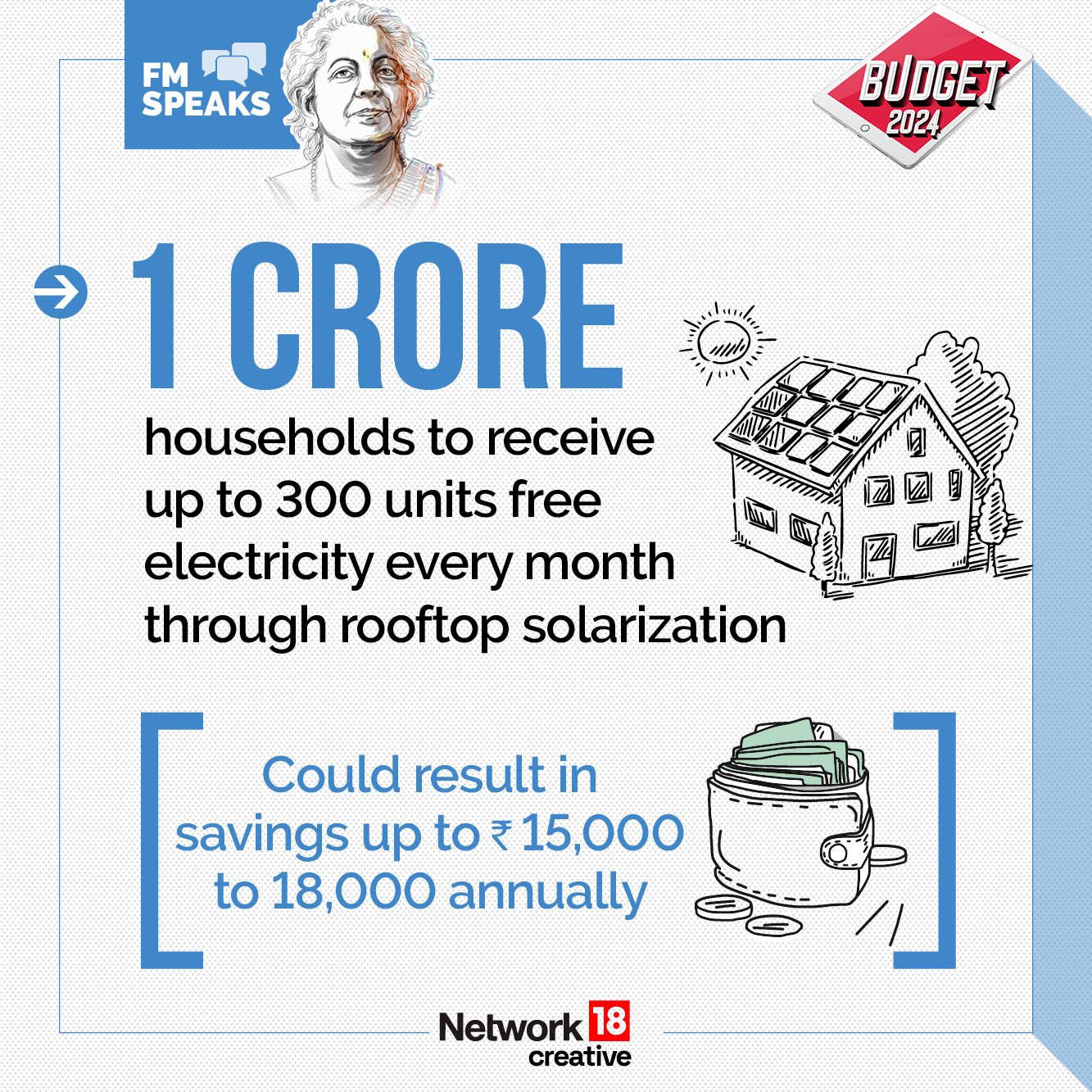

Sitharaman mentioned the promise made by Prime Minister Narendra Modi on reducing electricity bills for the poor, after the pran pratistha ceremony at Ayodhya’s Ram Mandir on January 22. While listing out the benefits that are expected from the rooftop solarisation programme, the finance minister said that the Prime Minister’s “resolve” to bring about the scheme after the historic consecration ceremony is leading to its implementation. She further mentioned that the scheme is not only expected to result in savings for households, but it will also generate opportunities for entrepreneurship and employment. Households can save up to Rs 18,000 per year from the free solar electricity that will be provided along with the surplus to the distribution companies, the finance minister added.

Sitharaman also announced the government will strengthen the electric vehicle ecosystem by supporting the manufacture of EVs and building charging stations, as well as encouraging a greater adoption of electric buses for public transport.

Prime Minister Narendra Modi called the interim budget, “inclusive” and “innovative” adding that it will make the common man’s life easier.

“Income-tax remission scheme will provide relief to 1 crore people from the middle class. In this budget, important decisions have been taken for the farmers,” PM Modi said.

Congress MP Manish Tewari expressed concern about the budget deficit. “It is a ‘vote-on-account’ which has only one purpose to keep the government solvent for the first quarter of the current fiscal year. What’s worrying is that there is a budget deficit of Rs 18 lakh crores. This means that the government is borrowing for its expenditure. This number is only going to increase next year,” he said.

Industrialist Anand Mahindra though hailed the interim budget. The Mahindra Group chairman said too much drama is created around the budget every year, which raises expectations of policy announcements to an “unrealistically feverish pitch”. “The Budget is NOT necessarily the occasion for transformational policy announcements. Those can, and should, happen throughout the year,” he wrote on social media site X. “Just as it is for all private households, the Budget is an opportunity to plan our finances prudently and with fiscal rectitude. The more we are focussed on living within our means and investing for a robust but sustainable future, the more confidence we will gain with global investors.”

(With agency inputs)