Getty Images

Getty ImagesThe Treasury should have disclosed a £9.5bn overspend in the public finances in the run-up to the previous government’s Spring Budget “under the law”, the UK’s spending watchdog has said.

Richard Hughes, chair of the Office for Budget Responsibility (OBR), told a committee of MPs on Tuesday the Treasury should explain why information was “not provided to us”.

His comments prompted the committee’s chair and Labour MP Meg Hillier to suggest the Treasury “may have broken the law”.

A Treasury spokesperson told the BBC it had acted “within the law” but said it had made changes to make sure the “unidentified pressures… never happen again”.

The Conservative party has been contacted for comment.

Last week, the OBR said the previous government “did not provide” them with all available information at former chancellor Jeremy Hunt’s last Budget in March.

The £9.5bn overspend forms the basis of Chancellor Rachel Reeves’ claim that the Conservatives left Labour with a significant “hole” in the public finances.

Asked by the committee on Tuesday how the shortfall could have happened, the OBR’s Mr Hughes said “the system very clearly broke down”, but insisted “that kind of failure will not happen again” because of processes put in place since.

The OBR works closely with the Treasury. Its role is to assess the government’s tax and spending plans and produce reports on whether the chancellors’ plans are sound.

Its judgements and forecasts are closely watched by financial markets to determine if the UK’s economic plans are credible.

Pushed on whether the Treasury broke the law over not disclosing an overspend, Mr Hughes said there may “have been a misunderstanding of how the law ought to be interpreted”.

“There is no doubt in our minds that had that information been provided we would have had a materially different judgement,” he added.

He said it “was a question for the Treasury to ask: why was information available within the Treasury and not provided to us?”

In summarising Mr Hughes’ comments, Hillier said: “The Treasury may have even broken the law in the run-up to the Spring Budget in not disclosing all the spending information.”

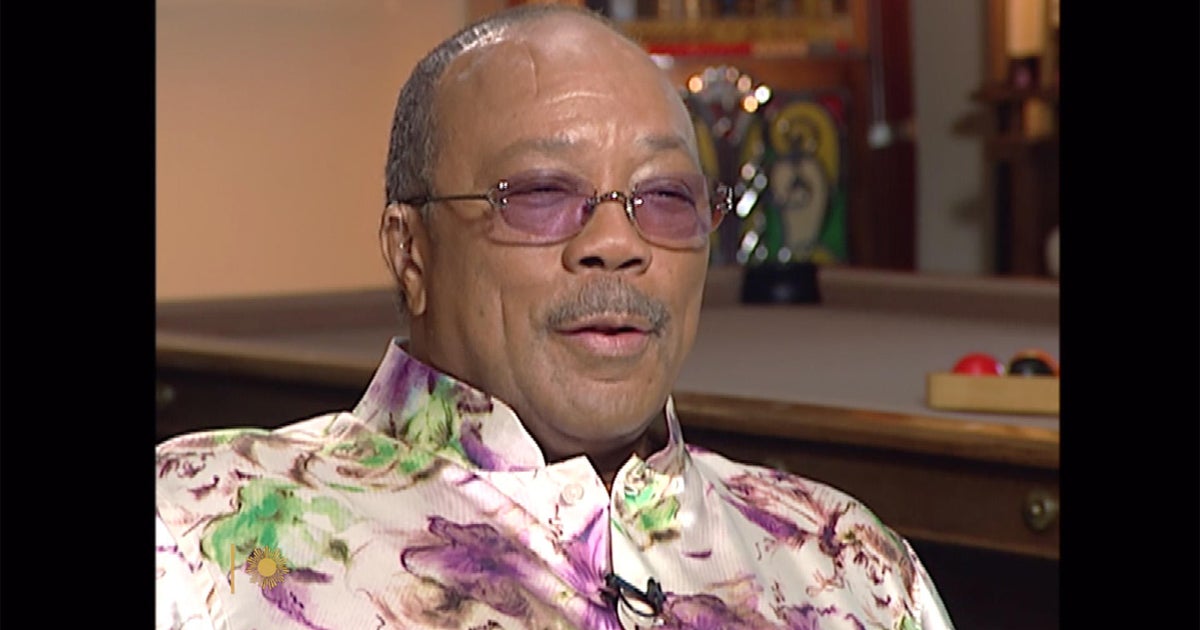

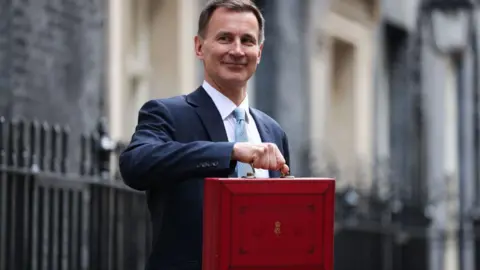

Shadow chancellor Hunt has previously accused the OBR of failing to act in a “politically impartial manner” by releasing its findings about the overspend on the day of the Budget last week, arguing it would help make the case for Labour’s big tax rises.

Hunt said it was “impossible to know” how much of the £9.5bn would have been compensated for by savings elsewhere.

A Treasury spokesperson told the BBC: “At the time of the Spring Budget, we communicated to the OBR the decision that ministers would manage spending pressures by making offsetting savings. This was within the law.

“We have accepted all the recommendations put forward by the OBR in its review of the March 2024 forecast.

“This is enshrined in the new Charter for Budget Responsibility to ensure that the unfunded pressures identified at the Public Spending Audit never happen again.”

‘Workers hit more than employers by NI tax rise’

Separately, the OBR told the committee workers will take most of the hit from the upcoming increase to employers’ National Insurance (NI) contributions.

At the Budget, Reeves said employers will pay NI at a rate of 15% on salaries above £5,000 from April, up from 13.8% on salaries above £9,100.

The OBR has calculated that three quarters of the impact would be felt by employees as bosses hold back on pay rises and hiring in the face of higher wage bills.

The watchdog’s Prof David Miles said it was “very plausible” this would disproportionately affect lower-paid workers.

Prof Miles said the OBR estimated employers would only take around a quarter of the hit from the NI changes in terms of lower profits, and suggested that the rest would be felt by workers.

He said part of the reason for this was the reduction of the threshold for employers paying the tax.

However, he suggested that the personal impact for workers might see “a bit of an offset” with the increase to minimum wages announced in the Budget.

The OBR’s comments come after much debate around Labour’s manifesto claim that there would be no tax rises on “working people” following its first Budget in 14 years.

James Smith, research director at the Resolution Foundation think tank, argued that the NI changes were “definitely a tax on working people”.

“Even if it doesn’t show up in pay packets from day one, it will eventually feed through to lower wages,” he said.

Chancellor Rachel Reeves has defended increasing taxes for employers in last week’s Budget while saying she is “not immune” to the criticism she has received.

She told the BBC the money raised would help put public finances on a “firm footing”.

The decision has come under fire from many businesses, including GPs who argue it could hit services for patients.