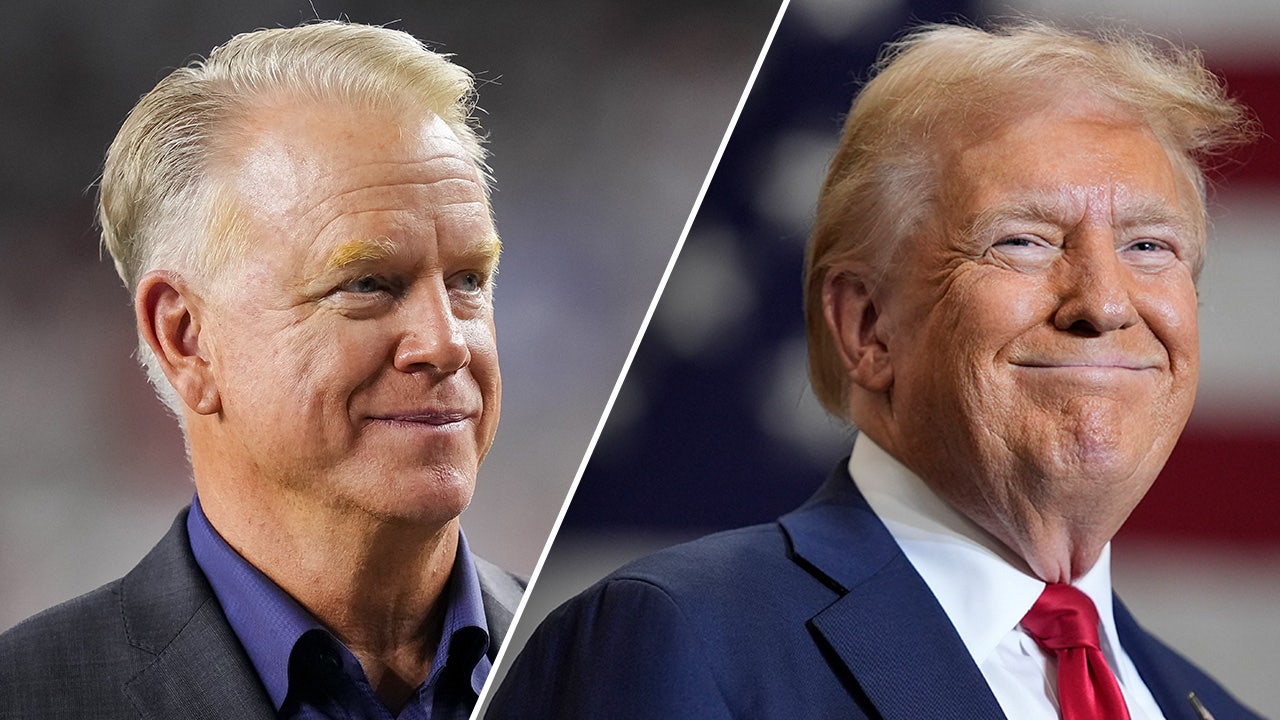

The dollar index slid to a roughly one-year low of 100.78. (File)

London:

The dollar headed for its longest stretch of weekly losses in almost three years on Friday, as traders ramped up expectations of an imminent end to the U.S. Federal Reserve’s rate-hike cycle following signs that inflation may be cooling.

Data on Thursday showed U.S. wholesale prices, as measured by the producer price index (PPI), fell by the most in nearly three years last month, a day after data showed the consumer index – CPI – was also softening as expected.

The dollar index, which measures the performance of the U.S. currency against six others, slid to a roughly one-year low of 100.78.

It was last down 0.1% at 100.90, and was headed for a weekly decline of more than 1%, its steepest drop since January. This would mark a fifth straight weekly loss, the longest such stretch since July 2020.

“The CPI rise was close to expectations, so it’s a significant market reaction for what was a fairly consensus outcome and I think that is a measure of how negative sentiment is on the dollar at the moment,” RBC Capital Markets chief currency strategist Adam Cole said.

“It’s kind of hard to fight that, even if you don’t really agree with it, which we don’t,” he said.

RBC Capital Markets have a year-end target of $1.03 for the euro/dollar pair, which on Friday, was trading around $1.1061, up 0.1% on the day and at one-year highs.

Out of the G10 currencies, investors hold the largest bearish position in the dollar against the euro.

Weekly data from the Commodity Futures Trading Commission shows money managers collectively held a $19.631 billion long position in the euro, while holding short positions against the yen, sterling, the Canadian, Australian and New Zealand dollars, and the Swiss franc.

“The easiest way to express a dollar-negative view has been with the euro,” Ray Attrill, head of FX strategy at National Australia Bank, said.

The next data point for investors are U.S. monthly retail sales at 1230 GMT, which will give a steer on how the U.S. consumer held up in the face of turmoil in the banking sector that brought down two regional lenders and hammered shares in others.

Economists polled by Reuters expect retail sales to have fallen 0.4% in March from February.

The pound hit a 10-month high of $1.2545 earlier in the day, and was flat at $1.2512. Against the euro, it was down 0.2% at 88.43 pence.

Money markets are attaching a 69% chance the Fed will raise interest rates by 25 basis points (bps) next month, though a series of cuts are also being priced in from July through to the end of the year, which would see rates at 4.3% in December, compared with a range of 4.75-5.00% right now.

Atlanta Fed President Raphael Bostic told Reuters in an interview on Thursday that one more 25-bps increase would allow the Fed to close out its cycle of rate rises with some confidence inflation would steadily return to its 2% target.

Recent inflation data, including this week’s reports of slowing consumer price increases and falling producer price inflation, “are consistent with us moving one more time,” he said. “We’ve got a lot of momentum suggesting that we’re on the path to 2%.”

Meanwhile, an unexpected surge in Chinese exports, alongside a robust March employment report in Australia, has put the Australian dollar on course for a 1.5% gain this week. It was last down 0.1% at $0.6775, The Australian and New Zealand dollars are often used as more liquid proxies for China’s yuan.

The New Zealand dollar eased 0.1% to $0.62925, after jumping 1.3% on Thursday.

The Japanese yen rose marginally, leaving the dollar 0.1% down on the day at 132.41, while the offshore yuan rose 0.3% to 6.8517 per dollar.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)