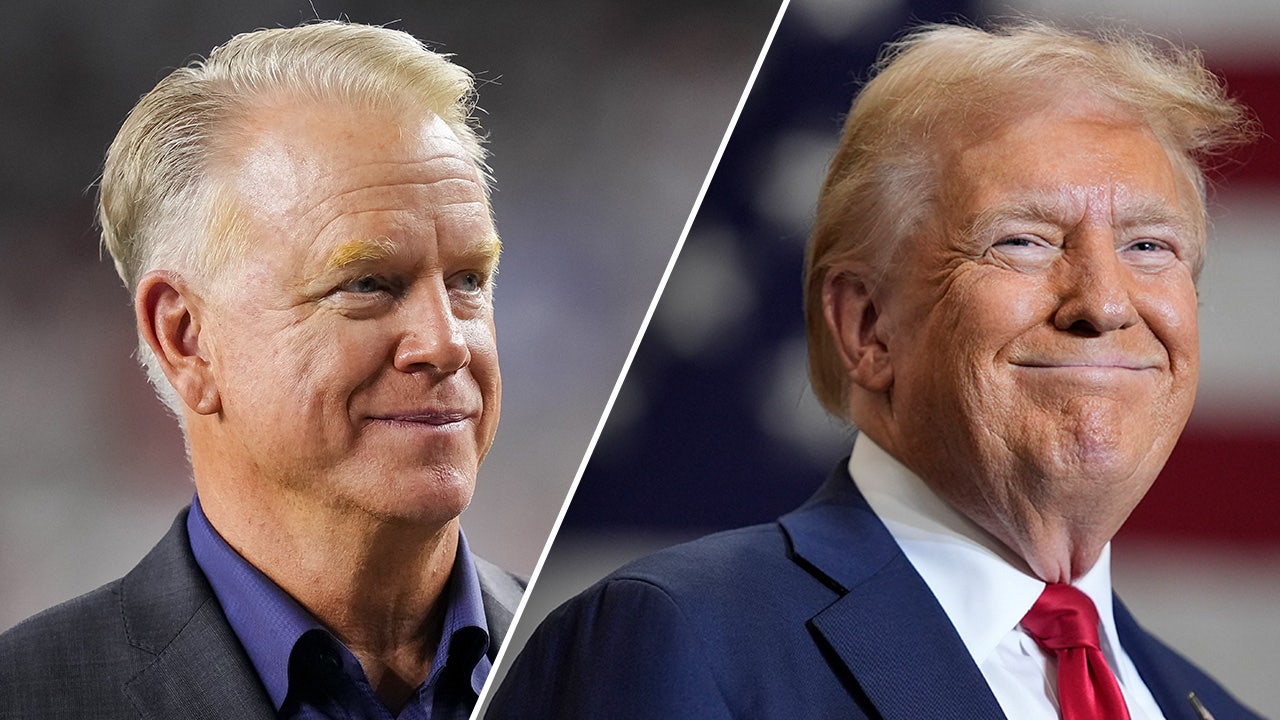

ESPN conversations ongoing with potential partners says Chairman Jimmy Pitaro

ESPN chairman James Pitaro at a Yankee’s baseball game at Yankee Stadium in The Bronx.

The Washington Post | The Washington Post | Getty Images

ESPN and its parent company Disney have been in discussions with potential strategic partners, ESPN Chairman Jimmy Pitaro said Tuesday.

Pitaro said Tuesday he and Disney CEO Bob Iger had started the discussions with potential partners in light of accelerated cord cutting from the traditional cable TV bundle.

Last week, CNBC reported ESPN had talks with professional sports leagues including MLB, NFL and NBA. Pitaro wouldn’t comment on potential partners and discussions.

“I will emphasize the fact we believe there are parties out there that can help us on the content side,” Pitaro said. He noted potential partners could come from the tech, marketing, content and distribution sides of the business.

Earlier in July, Iger said on CNBC that the company is interested in selling an equity stake in ESPN, and is looking for a strategic partner. The admission came after Iger noted the company was rethinking its traditional cable-TV channel portfolio and would be open to selling the networks or exploring other options.

-Lillian Rizzo

Disney and ESPN are attempting a business pivot few companies have ever made

The Disney+ website on a laptop computer in the Brooklyn borough of New York, US, on Monday, July 18, 2022.

Gabby Jones | Bloomberg | Getty Images

There have been plenty of headlines about Disney CEO Bob Iger‘s search for strategic partners for ESPN, but Aryeh Bourkoff, Chairman & CEO of investing firm LionTree, says one aspect of the story many have not focused on enough is just how rare this kind of business pivot is in the recent history of the markets.

After ESPN chairman James Pitaro said conversations were ongoing with potential partners, and early, when it comes to migrating its flagship channels to direct-to-consumer (DTC) platforms, Bourkoff said we are now in a world were companies like Amazon and Disney and other parts of ecosystem have to come together in the shift to a DTC model, and media players and tech players are both competitors and partners, and the leagues which ESPN has been rumored to be in talks with, are potential partners that have been part of the cost structure of ESPN.

“There is a way to bring it all together that preserves the cash flow model during these transitions, and to do it as pubic company in front of shareholders is virtually unheard of,” Bourkoff said. Whether Reed Hastings with DVD to streaming or Amazon from books to Prime, and now ESPN from linear to DTC, there have been few parallels, Bourkoff said.

And in the current regulatory environment, what used to work — M&A — is no longer an option. “You need to do it with partnerships,” he said. “Partnerships are the new M&A with leagues or private equity or rights holders. Otherwise, there will be too much pressure.”

—Eric Rosenbaum

We’re here live in Los Angeles

The CNBC x Boardroom Game Plan sports business conference in Los Angeles on July 25, 2023.

Ian Thomas, CNBC

Athletes, sports executives, owners, investors and other sports and entertainment leaders are arriving now in Los Angeles for the start of the Game Plan sports business conference.

There should be plenty of discussion around the future of sports and the challenges that lie ahead, whether that’s the integration of technology, reaching fans or creating new revenue streams – and where all three intersect.

— Ian Thomas

The big questions for ESPN and Disney

A little more context ahead of Game Plan’s first session:

The migration from linear TV to streaming has placed enormous pressure on the financial strength of legacy media companies, Disney as much as any media giant. Its marquee cable asset, ESPN, has suffered for years as Americans cut the cord. In a recent interview with CNBC’s David Faber, Disney CEO Bob Iger said the linear TV business has degraded over the past year more than he expected. “If anything, the disruption of that business has happened to a greater extent than even I was aware,” he said.

Iger told Faber of potential ESPN deal-making, “We’re going to be open minded about looking for strategic partners that could either help us with distribution or content. I’m not going to get too detailed about it, but we’re bullish about sports as a media property.”

Shortly after that, CNBC media reporter Alex Sherman reported that the MLB, NFL and NBA were in discussions with ESPN and Disney to take minority stakes. The NBA said it is always interested in discussions about “the future of its partnership” with ESPN. (Disney and Warner Bros. Discovery have exclusive negotiating rights with the NBA until next year.) The NFL has been interested in extending its ownership of NFL-related media in a variety of ways.

One of the key executives in those discussions, ESPN chairman James Pitaro, is up first at Game Plan and all eyes and ears will be on his comments about the future of the sports network.

—Eric Rosenbaum