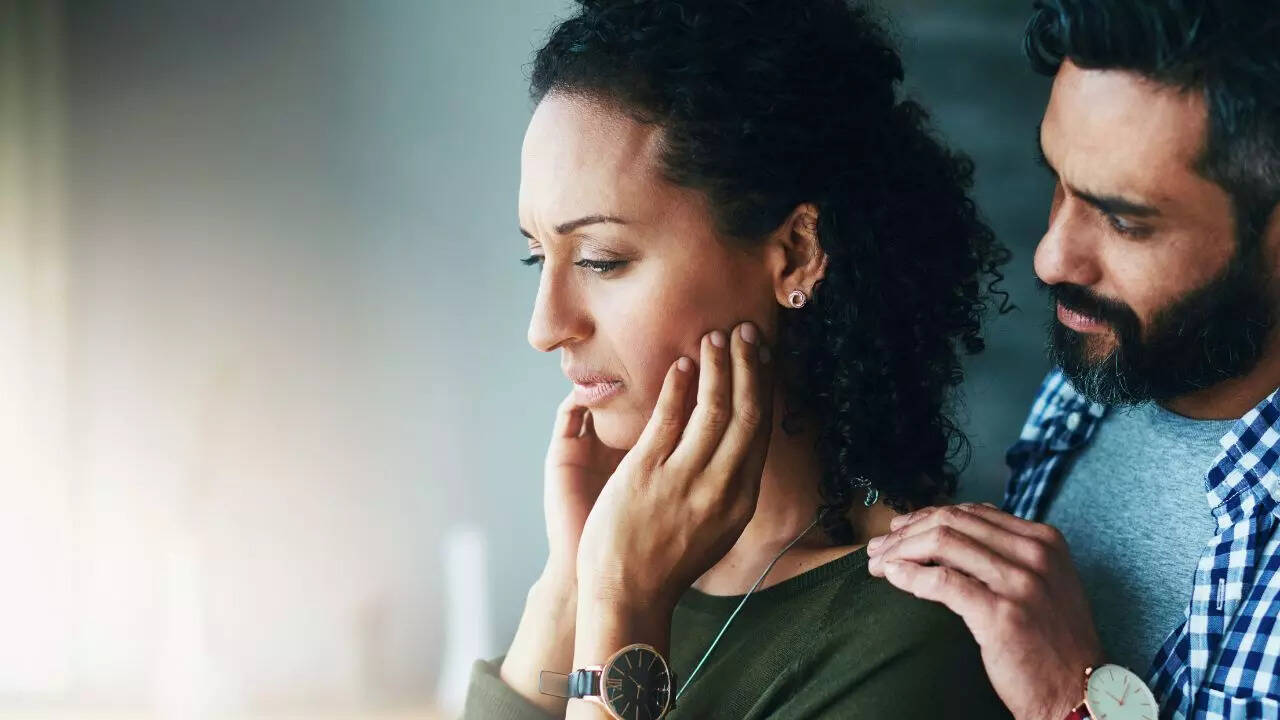

Tokyo Tower and Christmas street light up from Roppongi.

Kinsei-tgs | Istock | Getty Images

Asia-Pacific markets rose across the board Tuesday, rebounding from a sell-off in the previous session, with the Nikkei 225 hitting a fresh 33-year intra-day high on the back of gains in tech stocks.

Investors assessed December inflation numbers for Japan’s capital city of Tokyo, which are a leading indicator for nationwide inflation.

Tokyo’s inflation rate slowed to 2.4% in December from 2.6% in the previous month. Core inflation — which strips out prices of fresh food — remained unchanged at 2.1%, and came in line with expectations.

Australia’s retail sales for November 2023 also rose more than expected, gaining 2% month-on-month and beating economists expectations of 1.2% in a Reuters poll.

The country’s benchmark S&P/ASX 200 index climbed 1.02%.

Japan’s Nikkei 225 gave up some gains but was still up 1.2%, as trading resumed after a public holiday; the Topix advanced 0.81%.

South Korea’s Kospi advanced 0.29% even as heavyweight Samsung Electronics cut its earnings forecast for the fourth quarter of 2023, while the small-cap Kosdaq gained 0.81%.

Hong Kong’s Hang Seng index inched up 0.34%, while the mainland Chinese CSI 300 was up 0.29%.

Overnight in the U.S., all three major indexes gained, boosted by tech shares.

Shares of Nvidia rose 6.4%, reaching an all-time high, and Amazon climbed nearly 2.7% to help pull the Nasdaq higher. Separately, Alphabet shares advanced 2.3%, while Apple added 2.4% after Evercore ISI advised clients to buy last week’s dip.

The S&P 500 gained 1.41%, and the Nasdaq Composite jumped 2.2% to mark the tech-heavy index’s best day since Nov. 14.

The Dow Jones Industrial Average added 216.90 points, or 0.58%, settling at 37,683.01.

— CNBC’s Sarah Min and Pia Singh contributed to this report