Palo Alto Networks (PANW) shares jumped more than 15% on Monday, clawing back in one session most of the damage they incurred since the beginning of August. The catalysts were the cybersecurity leader’s solid fiscal 2023 fourth-quarter results, reported after the closing bell Friday, and management’s medium-term financial outlook. Those factors led us to change our Club price target on the stock. Revenue for the quarter increased 26% year-over-year to $1.95 billion, a tick below the consensus estimate of $1.96 billion that was compiled by Refinitiv. Adjusted earnings per share (also known as non-GAAP) grew 80% to $1.44, ahead of estimates of $1.28 per share. (GAAP stands for generally accepted accounting principles .) EPS on a GAAP basis increased to 64 cents, compared with a penny in the year-ago period and well above forecasts for a 43-cent per-share profit. Total billings increased 18% year-over-year to $3.16 billion, marginally below the estimate of $3.17 billion. However, it was in line with management’s forecast. (The billing line item provides insight into the health of a subscription software business by measuring what’s been invoiced to customers for products and services.) PANW YTD mountain Palo Alto Networks YTD performance Bottom line The concern over whether a summer Friday evening earnings release might mean bad news proved unwarranted. Palo Alto Networks delivered largely better-than-expected quarterly numbers, with even better guidance for the current quarter (fiscal 2024 first quarter), full-year fiscal 2024, and beyond. There were some things for investors to nitpick — sales missed marginally, billings were a hair short, and Subscription and Support results came in a tad below expectations. The weak spots were more than offset by strong profit margins, better than expected free cash flow — and above all, favorable guidance both near-term and in the years to come. Remember, Palo Alto’s news late Friday encompassed more than just the reported quarter and the near-term outlook. Management spent another hour on the post-earnings call talking about their medium-term outlook through the company’s fiscal year 2026. While sales projections for the near term and that extended period came up a bit short, everything else — including forecasts for billings, operating margin, earnings, and free cash flow — was in line or better than expectations. Monday’s reaction on Wall Street to Friday’s quarterly release and medium-term outlook is yet another example of how long-term investors are best served by blocking out short-term noise and instead focusing on underlying business fundamentals — the quality of the actual business overall, not three months’ worth of demand against an incredibly uncertain and volatile operating environment — and longer-term growth drivers. While reiterating our 1 rating on the stock, we can’t advise chasing this move just yet. Let traders book their profits in the coming days and look for a slight pullback or some sideways action. We do think PANW shares are destined to go higher in the next six to nine months — thus, we are increasing our price target on the stock to $280 from $245. That’s nearly 14% above Monday’s session high, reflecting a price-to-earnings valuation of about 50 times fiscal 2024 earnings estimates. That’s not a cheap multiple, but it’s only slightly higher than the five-year average of 47.5 times. We think the slight premium is warranted because Palo Alto is now clearly taking market share in the rapidly growing and mission-critical cybersecurity industry. Quarterly commentary As we see in the table above, despite a top-line miss that came as a result of lower than expected Subscription and Support revenue, earnings managed to easily outpace expectations, thanks to strong gross and operating margin performance. Equally important, adjusted free cash flow and free cash flow margin were both better than expected. Billings were a bit short, as noted earlier, but only just barely as guidance ( covered in detail in the next section ) was better than expected. On the call, management talked about the payoff they’ve been seeing in their strategy of building out the best individual tools to protect clients’ businesses from hackers and focusing intensely on the integration of those tools into a comprehensive platform. “We are lucky that we’ve been focusing on a platform strategy, so we can usually walk in and say, here, you can consolidate the following five, it doesn’t cost you any more but you get a better outcome and you get a modernized security infrastructure,” CEO Nikesh Aurora said on the call. This has been core to our investment thesis and a key reason why we refused to allow negative commentary from competitor Fortinet (FTNT) — which lacks a robust, fully integrated suite of tools — to shake us out of Palo Alto. In fact, despite all that, we upgraded our rating Palo Alto after what we felt was unwarranted selling since the Fortinet remarks after the close on Aug. 3. On the call, Palo Alto management did note the company, like everyone, is seeing more scrutiny before deals close with “the rising cost of money [causing] customers to hold on to their cash and more frequently seek deferred [payment terms].” It is clear, however, that at a higher level, Palo Alto is taking market share. Such efforts by management teams to work with clients on payments are why the Street tends to focus more on billings than earnings when it comes to longer-term, contract-based software sales. Billings include deferred revenues — and as a result, provide additional insight into sales efforts. Palo Alto may not be able to record all that revenue — deferred revenues are realized as the associated good or service is provided — but billings give us insight into demand beyond the reported quarter. Guidance For its fiscal 2024 first quarter, the company is forecasting: Total billings between $2.05 billion and $2.06 billion, ahead of the $2.04 billion expected. Total revenue of $1.82 billion to $1.85 billion, below the $1.93 billion we were looking for. (That said, as explained above, billings include deferred revenue — and as a result, tend to take priority for software companies that sell services on extended contracts. So, we’re not too concerned about this given the strong billings guidance.) Non-GAAP earnings are expected in the range of $1.15 to $1.17 per share, ahead of the $1.11 per share consensus estimate, even on the low end. For the full-year fiscal 2024, management sees: Total billings between $10.9 billion and $11.0 billion, ahead of the $10.8 billion estimate. Total revenue of $8.15 billion to $8.2 billion, below the $8.38 billion expected. Non-GAAP earnings are expected in the range of $5.27 to $5.40 per share, ahead of the $4.98 per share consensus estimate, even on the low end. Adjusted free cash flow margin of 37% to 38%, in line with expectations. Looking further out, through the company’s fiscal year 2026, the team sees: The total addressable market (TAM) opportunity expanding from $104 billion in fiscal 2023 to $163 billion by fiscal 2026. Management noted their roughly 7% share of TAM remains well below that of leaders in other markets. The implication here is the potential opportunity stands to increase as Palo Alto gains market share. Compound annual growth rate (CAGR) for revenue and billings of 17% to 19% between fiscal year 2023 and fiscal 2026, with only about 10% of sales coming from hardware. The Street has been modeling for a sales CAGR of about 21.6% and a billings CAGR of 16.9%. Non-GAAP operating margin of 28% to 29% by fiscal year 2026 with eyes on a low-to-mid-30s operating margin after that. Analysts were closer to 26% by FY2026 so a very strong guide for profitability. CAGR of 20%-plus between fiscal year 2023 and fiscal year 2026. The Street was modeling a roughly 18.5% CAGR. Adjusted non-GAAP free cash flow margin sustaining at 37%-plus for fiscal year 2024 through fiscal year 2026. That was in line with expectations. Roadmap for AI Palo Alto management also talked about how artificial intelligence will revolutionize their ability to safeguard computer networks and catch hackers in the act of a breach. “What we think lies ahead is the need for security to stop bad actors mid-flight real-time as it’s happening. If you think about security today, the industry is only 30% or 40% real-time,” the team said. “We sit at a point where everybody’s talking about AI and actually that is the solution. The solution is to make sure you ingest large amounts of data, you analyze them on the fly, and you’re able to deliver superior security outcomes,” they added. (Jim Cramer’s Charitable Trust is long PANW. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

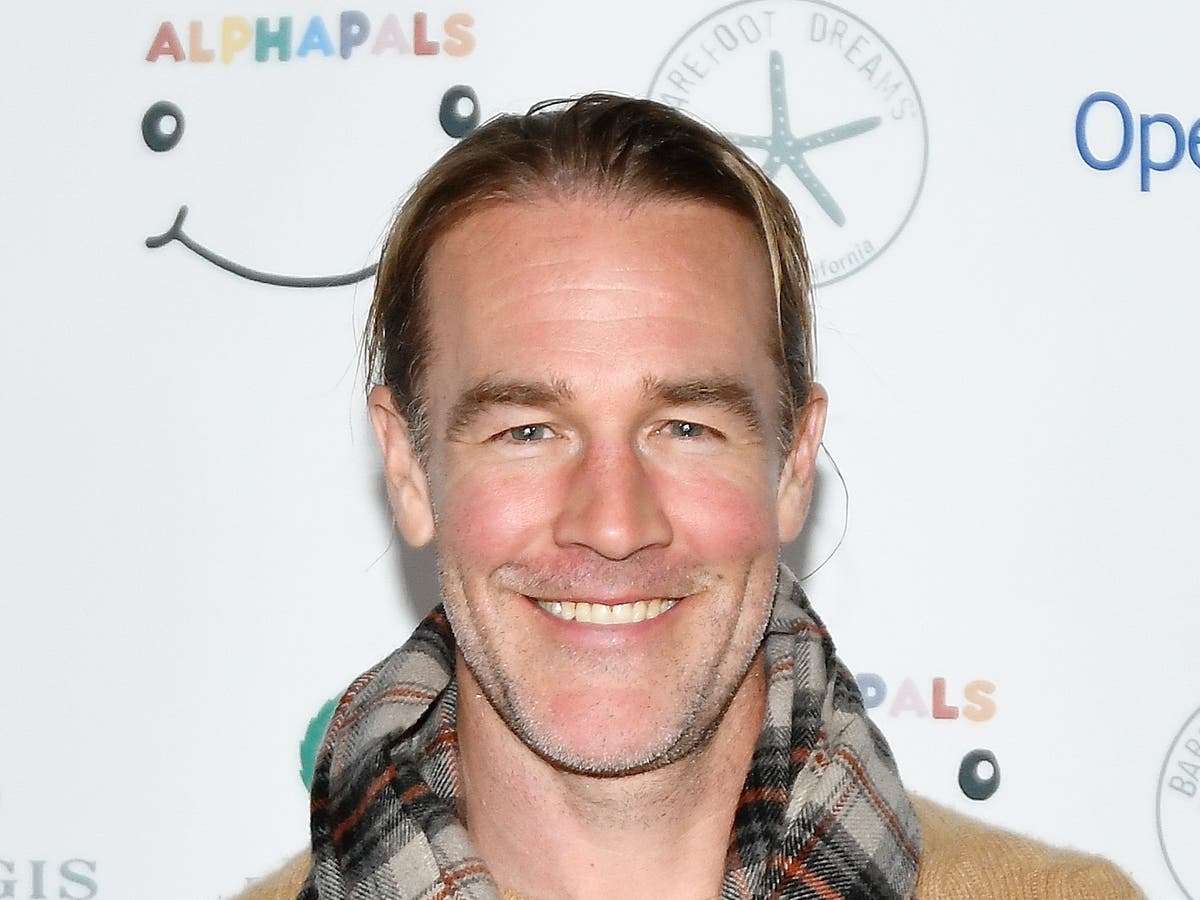

Signage outside Palo Alto Networks headquarters in Santa Clara, California, U.S., on Thursday, May 13, 2021.

David Paul Morris | Bloomberg | Getty Images

Palo Alto Networks (PANW) shares jumped more than 15% on Monday, clawing back in one session most of the damage they incurred since the beginning of August. The catalysts were the cybersecurity leader’s solid fiscal 2023 fourth-quarter results, reported after the closing bell Friday, and management’s medium-term financial outlook. Those factors led us to change our Club price target on the stock.