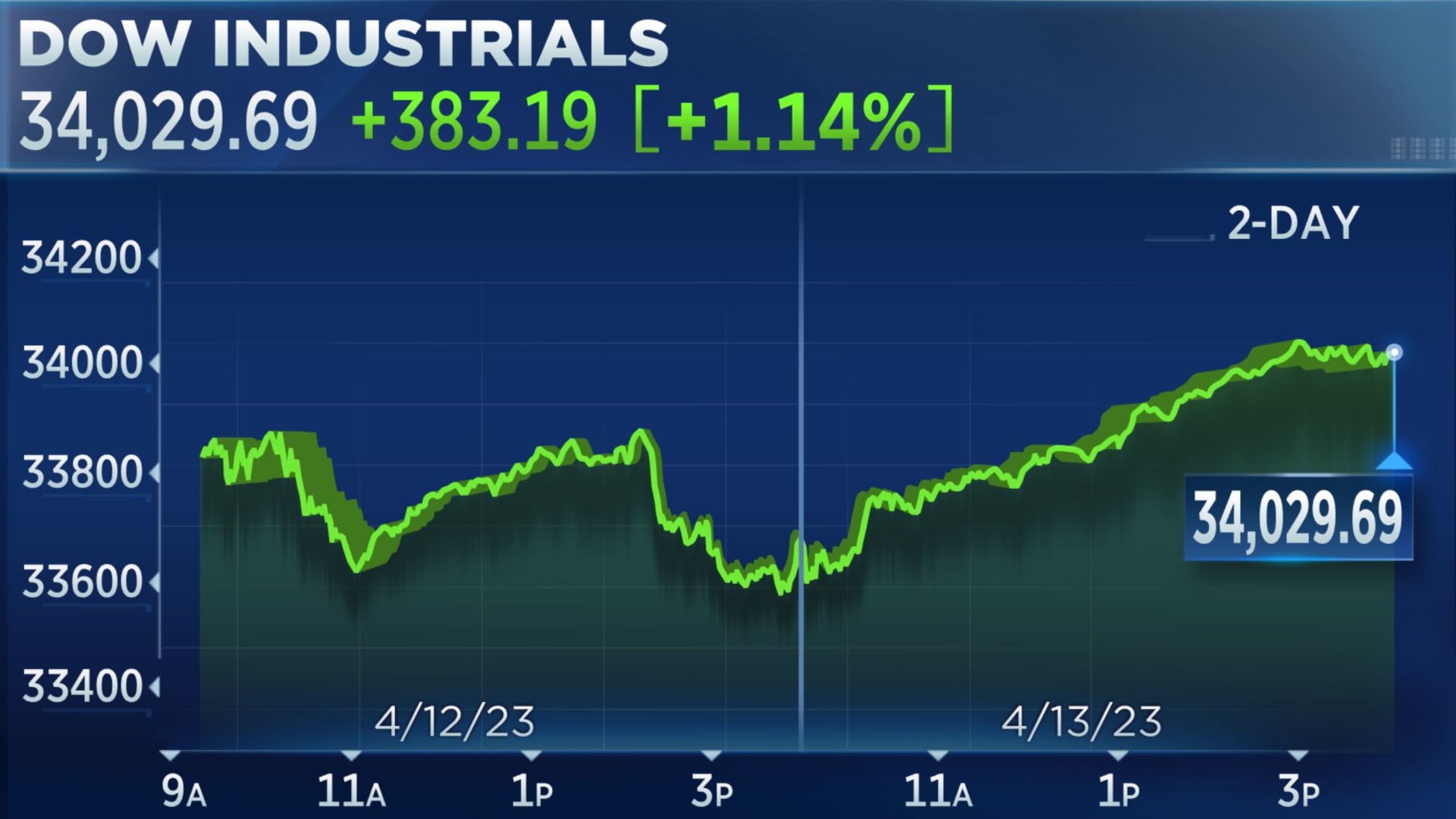

Stocks jumped Thursday as traders cheered another report pointing to cooling U.S. inflation.

The S&P 500 climbed 1.33% to 4,146.22 for its highest close since February. The Nasdaq Composite advanced 1.99% to 12,166.27. The Dow Jones Industrial Average added 383.19 points, or 1.14%, to 34,029.69.

The March producer price index, a measure of prices paid by companies and often a leading indicator of consumer inflation, declined by 0.5% month over month versus economists’ expectations for prices to be flat. Excluding food and energy, the core wholesale prices reading shed 0.1% month over month, much better than the 0.2% increase expected by economists polled by Dow Jones.

The PPI data confirmed the easing inflation trend from Wednesday’s March’s consumer price index report, which advanced just 0.1% month over month. Consumer prices grew 5% on an annual basis, the smallest increase in nearly two years.

S&P 500 YTD

Tech stocks, which were among the hardest hit during periods of rising inflation and rates, leapt Thursday. Both the communication services and information technology sectors were among the notable gainers in the S&P 500. Mega-cap tech stocks advanced, with shares of Amazon up 4.7%. Shares of Google-parent Alphabet and Meta were up 2.7% and about 3%, respectively. Tesla shares also rose nearly 3%.

“The market was a little poised to potentially go up on any positive news, and in this case, the PPI number was quite a bit better than expected,” said Spouting Rock Asset Management’s Rhys Williams. “And I think that gives people some comfort that in fact the Fed probably doesn’t have to raise rates in the next meeting.”

Wednesday marked a 2-day losing streak for the S&P 500 as the minutes from the March Federal Open Market Committee meeting showed the Fed expects the recent banking crisis to cause a mild recession later this year.

“Markets might be getting a little too ahead of themselves, as far as optimistic, that the Fed will be able to cut when the markets are pricing that in,” said Verdence Capital Advisors’ Megan Horneman.

“I don’t think the Fed’s going to be able to do that. I think the Fed’s going to have to stay on hold for longer than people anticipate, and then maybe rate cuts next year, but I think they’re going to have to stay on hold because we still are in a very sticky inflation environment.”

Correction: Tech shares jumped on Thursday. An earlier version of this story misstated the day.