Charlie Munger, long regarded as CEO Warren Buffett’s right-hand man at Berkshire Hathaway, has died at age 99.

Munger died Tuesday in a California hospital, Berkshire Hathaway said in a statement posted on its website. Munger, who was Berkshire Hathaway’s vice chairman, is credited with helping Buffett build the company into a legendary financial firm known for its canny investments in companies such as Apple and GEICO, leading to spectacular stock gains over the past several decades.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said in the statement.

Indeed, Buffett’s 2022 annual letter to shareholders calculated that Berkshire Hathaway’s shares had gained more than 3,787,000% from 1965 through 2022, compared with a 24,700% gain in the S&P 500 over the same period.

Munger served as a sounding board on investments and business decisions for Buffett, with whom he shared much in common. Both were Nebraska natives who worked at the grocery store run by Buffett’s grandfather and uncle. Both also attended the same high school, although they didn’t meet while they were children given that Buffett, 93, is several years younger than Munger.

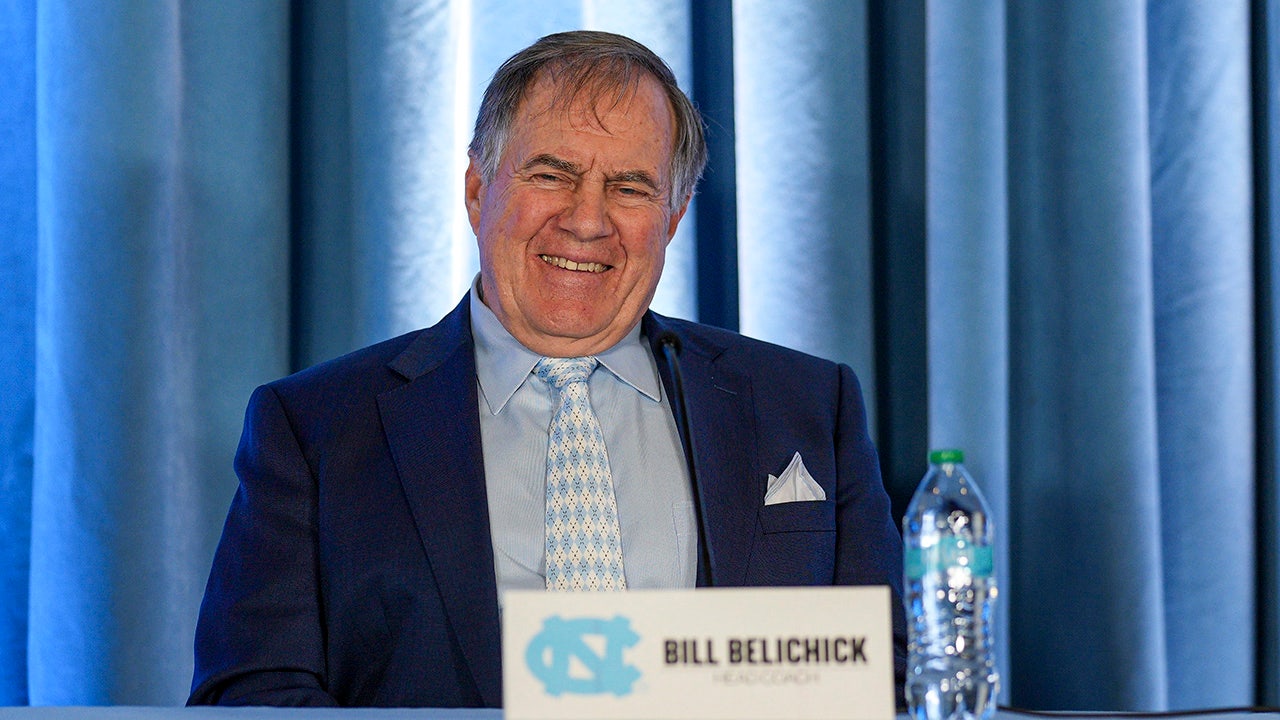

AP Photo/Nati Harnik

The pair met for the first time years later in 1959, at an Omaha dinner party when Munger was practicing law in Southern California and Buffett was running an investment partnership in Omaha. The two instantly hit it off and kept in touch through frequent telephone calls and lengthy letters, according to Munger’s biography in his book “Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger.”

After trading investment ideas, and even buying into the same companies during the 1960s and 1970s, Munger eventually joined Buffett at Berkshire Hathaway, becoming its vice chairman in 1978. Munger helped lead Berkshire for more than five decades.

Munger preferred to stay in the background and let Buffett be the face of Berkshire, and he often downplayed his contributions to the company’s remarkable success. That success made Munger enormously wealthy, with Forbes estimating his fortune at $2.6 billion.

A pleasant counterpoint to the congenial Buffett, Munger offered curmudgeonly quips at Berkshire Hathaway’s annual meetings, where he was known for dryly stating “I have nothing to add,” after many of Buffett’s expansive answers. But Munger never refrained from offering sharp insights that cut straight to the heart of the matter, such as advice he offered in 2012 on spotting a good investment.

“If it’s got a really high commission on it, don’t bother looking at it,” he said.

At the time of his death, Munger was also serving on the boards of directors at Costco, Daily Journal Corp. and Berkshire Hathaway, according to the financial data firm FactSet.

Prominent figures on Wall Street expressed their sadness at Munger’s death.

“For so many decades, the two of them led an investment powerhouse that significantly improved so many people’s lives … and, in the process, they repeatedly showcased the prowess of collaboration, synergies and common sense,” Mohamed El-Arian, chief economic advisor at Allianz, said on X, (formerly known as Twitter), referring to Munger’s partnership with Buffett.

A noted philanthropist, Munger recently made a $40 million gift to the Henry E. Huntington Library and Art Museum in San Marino, California, a California museum that he had supported in the past. He also donated to various learning institutions and both he and his late wife Nancy B. Munger, who died in 2010, were major benefactors of Stanford University.

Buffett always credited Munger with pushing him beyond his early value investing strategies to buy great businesses at good prices like See’s Candy.

“Charlie has taught me a lot about valuing businesses and about human nature,” Buffett said in 2008.

—With reporting by the Associated Press.