Traders at the NYSE, March 8, 2022.

Source: NYSE

The S&P 500 and Nasdaq Composite retreated on Friday, as Nvidia‘s incredible run took a breather and the market neared the conclusion of a choppy week.

The broad S&P 500 lost about 0.8%, while the tech-heavy Nasdaq Composite slipped 1.3%. Both swung into negative territory after rising to new all-time highs earlier in the session. The Dow Jones Industrial Average lost 66 points, or 0.2%.

After a rough start, the Dow and Nasdaq are down 0.6% and 0.4%, respectively, on the week. The S&P 500 ticked down 0.2% this week.

Stocks wobbled on Friday as an earlier rally in Nvidia lost steam. The artificial intelligence darling was last down more than 5% on the day. Despite that breather, shares are still up more than 6% on the week, extending a monster rally that has added more than $1 trillion to market cap value in just the new year alone.

“It doesn’t mean that the longer-term upside potential is over,” said Sam Stovall, chief investment strategist of CFRA Research, of Nvidia’s Friday move. “It just says that maybe we’ve gotten ahead of ourselves: We’ve gotten to an overbought situation, and it’s time to take some profits.”

Nvidia, 1 day

Though Nvidia dragged on tech, Apple rose more than 1% in Friday trading. With that gain, the mega-cap stock was on track to snap its longest losing streak since early 2022 at seven days. But shares were still down more than 4% on the week, making it the worst performer in the 30-stock Dow.

Labor data

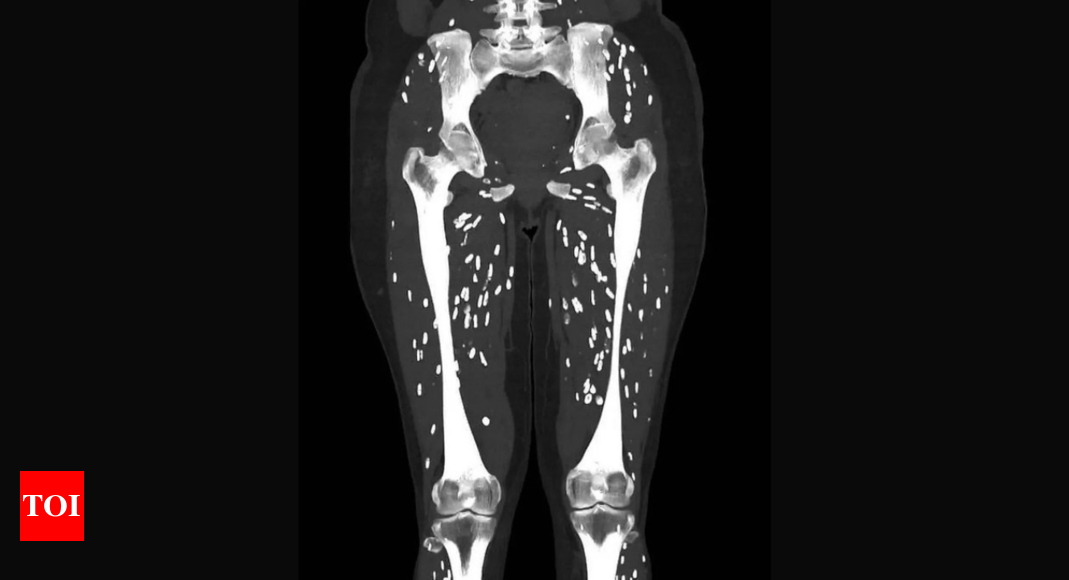

The February jobs data offered some conflicting signals as to when it will be safe for the Federal to start cutting interest rates.

On one hand, the number of jobs added last month was much more than expected, coming in at 275,000 compared with an estimate of 198,000 from economists polled by Dow Jones. This data can imply the economy is still running pretty hot.

But the unemployment rate unexpectedly ticked higher to 3.9% and wage growth was lighter than feared, offering morsels of hope that inflation has cooled enough to appease the Fed. Data on January jobs growth was also revised lower.

“In sum, people will be able to take away whatever message they want to from today’s reports,” said George Mateyo, chief investment officer at Key Private Bank. “However, we think the data skews positive and should provide sufficient confidence to the Fed that a modest adjustment to interest rates is appropriate.”